Rolled equity, or “a rollover,” is when the existing owners of a business sell the majority of their ownership interest but maintain a minority stake in the new entity structure, essentially reinvesting a portion of the sale proceeds — usually 10 to 40 percent of total equity value — back into the company.

The primary reason for buyers to include a rollover in their purchase price is to ensure that buyer and seller interests are aligned post-closing. Structuring a purchase offer to include a rollover equity stake is also a way to narrow the gap between buyer purchasing power and total sale price. The result allows for acquirers to spend less cash at close. Additionally, a buyer can reduce some of the risk associated with an acquisition by sharing it with a minority owner.

Rollover equity is particularly intriguing to sellers who have built their business and want to continue to capitalize on its future success, often referred to as getting a “second bite of the apple.” In this scenario, an increase in value over the acquirers hold period — typically three to seven years when the buyer is a private equity group — means more money for the seller when the business is sold a second time. Instead of cash up front, the initial seller is deferring compensation in hopes of a larger future pay out. Accepting a rollover as a portion of purchase price can also allow the seller to achieve a higher overall enterprise value while providing the opportunity to defer taxes.

Recently, non-cash forms of purchase price, including rollovers, have become more common and a more significant portion of enterprise value. This has allowed buyers to maintain higher valuation multiples while facing a tighter credit market and general market uncertainty.

M&A Market Activity

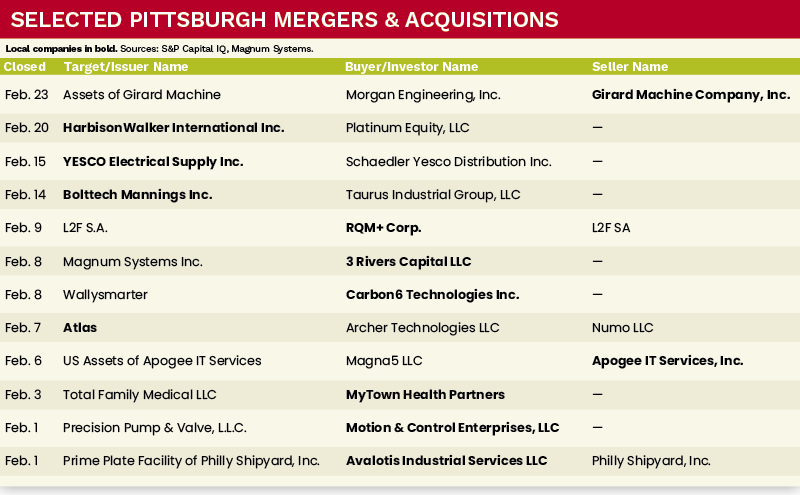

Domestic deal volume trends were consistent with January, remaining below 2022 levels. U.S. M&A deal volume for the month of February 2023 was 28.3 percent lower compared to the month of February 2022.

The Greater Pittsburgh M&A market realized significant growth in deal volume thus far in 2023, coming in at 10.3 percent higher compared to the same period in 2022. February 2023 realized several noteworthy transactions in the Greater Pittsburgh region, primarily driven by strategic acquirers. Pittsburgh area-based companies Carbon6 Technologies, Motion & Control Enterprises, and Avalotis Industrial Services completed strategic acquisitions within the month. In addition, Pittsburgh-based private equity group 3 Rivers Capital completed an acquisition of Magnum Systems, a leader in the industrial automation industry.

Deal of the Month

On February 8, 2023, 3 Rivers Capital announced the acquisition of Magnum Sys, a designer and manufacturer of handling and packaging systems for dry bulk materials. The acquisition marks the Pittsburgh-based private equity firm’s first investment in the industrial automation industry. According to Dale Buckwalter, co-founder and managing partner at 3 Rivers Capital, “Our acquisition of Magnum Systems reflects 3 Rivers Capital’s thesis-driven investment strategy focused on the industrial automation industry. We were impressed with management’s passion for the business and the range of solutions this long-standing company offers customers across diverse industries. We firmly believe that Magnum represents an ideal first investment into Industrial Automation as 3 Rivers Capital begins to execute on our commitment to this strategy.” ●

David Shibley is an Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].