The evolving private equity landscape is demonstrating resilience and renewed momentum in the face of persistent market uncertainty, particularly around global trade dynamics and tariff policies. While the new U.S. administration’s approach to tariffs has introduced new variables into dealmaking, particularly in cross-border scenarios, financial sponsors are navigating this environment with agility. Supported by a more favorable regulatory environment for dealmaking and greater alignment on valuation expectations, private equity investors are actively pursuing both acquisitions and exits. With a more favorable environment and signs of reduced scrutiny on larger transactions, firms are leaning into a market defined by regional divergence, shifting sector focus, and a growing willingness among both buyers and sellers to transact under well-understood frameworks.

Private equity activity has picked up materially in early 2025, with sponsors beginning to reinitiate exit processes amid a more receptive market backdrop and more predictable financing conditions. Many firms are now bringing portfolio companies to market after holding periods that, in some cases, extended beyond traditional timelines. On the acquisition side, privatization activity remains a dominant theme. Public market volatility has continued to create compelling entry points for buyers into the private equity space, especially in cases where companies are undervalued relative to long-term fundamentals. These factors enable sponsors to pursue long-term growth strategies without the pressure of quarterly reporting, unlike the public markets.

Private equity investors are increasingly focused on sectors that offer more stable regulatory conditions and are less vulnerable to external disruptions. While global opportunities still attract attention, much of the current activity is centered on industries where trade uncertainties and tariff risks are less of a concern. Although evolving tariff policies remain an important part of the diligence process, especially in supply chain-intensive industries, deal execution has remained strong for companies with more predictable cost structures and domestic-oriented operations. Firms are prioritizing investments in businesses that are insulated from international volatility, with a clear path to growth. As a result, capital is being deployed into companies with robust margins, scalable business models, and limited exposure to shifting trade policies.

With a sharper focus on geopolitical risks and regulatory trends, private equity firms are navigating the market with precision, fostering an environment where strategic flexibility and calculated risk-taking unlock long-term value and resilience.

M&A Market Activity

In April 2025, U.S. deal volume experienced a slight increase of 1.2 percent compared to March 2025. This uptick is attributed to a resurgence in private equity activity, particularly in sectors less affected by recent tariff implementations. Despite the broader market uncertainty, firms are leveraging strategic flexibility and focusing on industries with robust domestic operations to navigate the evolving landscape.

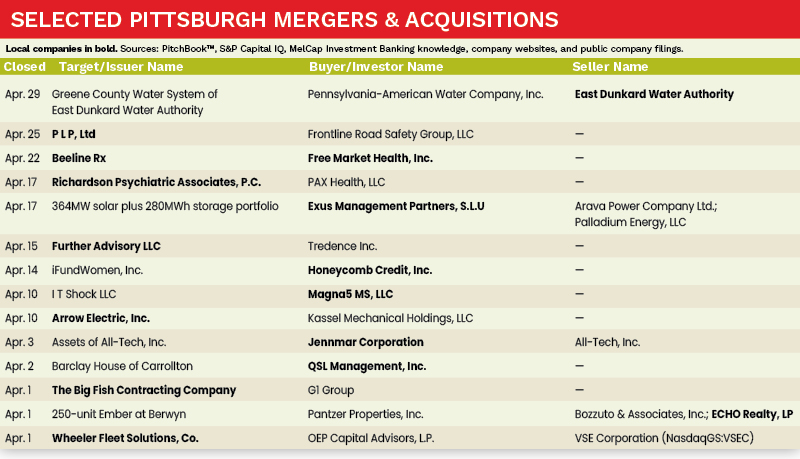

The Pittsburgh M&A market experienced a 27.3 percent increase in activity in April 2025 compared to the same period in 2024. Pittsburgh–based companies Jennmar Corporation, Honeycomb Credit, and QSL Management all completed acquisitions during the month of April.

Deal of the Month

On April 22, 2025, Pittsburgh–based Free Market Health announced the acquisition of Beeline Rx, a technology-driven company specializing in streamlining specialty drug access. The transaction unites two innovators in the specialty pharmacy space, combining complementary platforms and a shared mission to simplify care delivery and improve patient outcomes. Building on their collective strengths, the integrated organization is positioned to modernize prior authorization workflows, enhance EHR integration, and provide faster, more efficient coordination between prescribers, payers and pharmacies.

Sources: PitchBook™, S&P Capital IQ, MelCap Investment Banking knowledge, company websites, and public company filings.

Anthony A. Melchiorre is a director and principal at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].