Post-merger integration (PMI) is the stage where a transaction’s strategic vision starts to take shape and the groundwork for long-term value is laid. While deal execution often captures headlines, the success of an acquisition ultimately depends on how well two organizations come together operationally, culturally and strategically.

Successful integrations begin long before closing. The most effective acquirers treat integration planning as a parallel workstream to diligence, aligning leadership around strategic objectives and defining what “success” looks like early on. Integration teams that are embedded in deal discussions from the start are better positioned to anticipate potential friction points, prioritize critical systems and processes, and ensure alignment regarding customer and employee experience.

Cultural alignment is often the most underestimated component of PMI. Beyond systems and structures, people integration determines how quickly teams can work toward shared goals. Clear communication, transparent leadership, and deliberate culture-building help maintain morale and productivity through periods of uncertainty. Organizations that invest in cultural onboarding typically see faster stabilization and strong long-term performance.

Operational discipline is equally vital. Establishing a detailed integration roadmap covering technology, finance, operations and governance enables accountability and keeps post-close execution on track. Leveraging data and analytics can help monitor synergy realization and identify areas where value capture may lag.

The integration journey doesn’t end once systems are combined or reporting lines are redrawn. It continues as teams align around shared goals, refine processes and embed new ways of working. Firms that foster collaboration, maintain clear governance and actively manage change are more likely to sustain the momentum that turns deal rationale into long-term value creation.

M&A Market Activity

U.S. deal volume in October 2025 softened by 22.7 percent as compared to October of the prior year, with YTD volume just 2.7 percent below the total transactions for the prior YTD period. Conversely, aggregate deal value has climbed meaningfully in 2025, supported by a renewed appetite for high-quality assets and a rebound in strategic activity. Strong participation from both corporate acquirers and private equity investors has driven this momentum, signaling growing confidence in long-term growth sectors and more deliberate capital deployment.

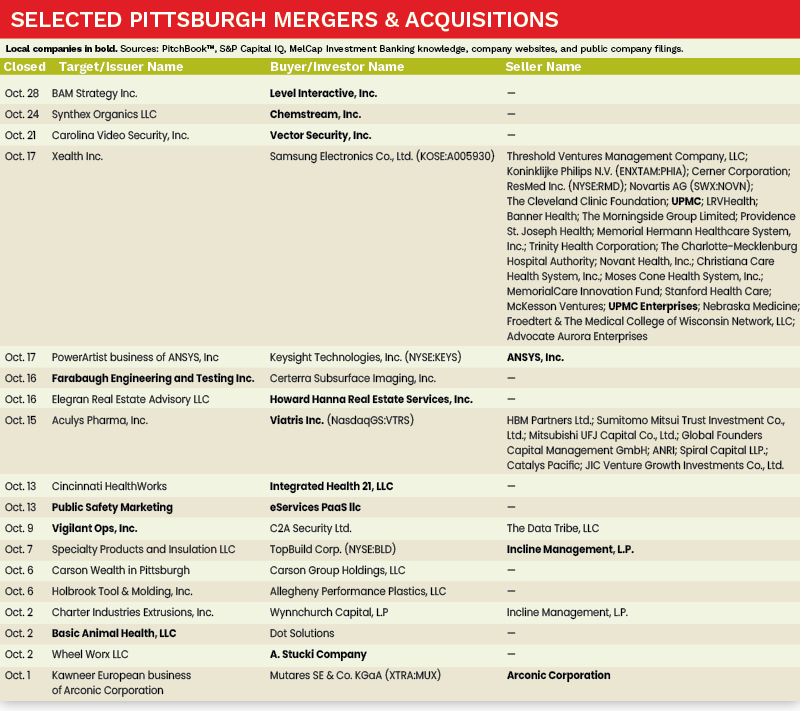

The Pittsburgh M&A market experienced a 20 percent increase in activity in October 2025 compared to the same period in 2024. Moreover, notable Pittsburgh-based companies, such as Viatris, Chemstream, and Level Interactive all completed strategic acquisitions, while Ansys and Arconic Corporation completed strategic divestitures, demonstrating the diversity of transactions in the region.

Deal of the Month

On October 2, 2025, Incline Equity Partners (Incline), a Pittsburgh-based private equity firm focused on middle-market investments, announced the sale of its portfolio company Charter Industries, a supplier of edgebanding solutions and related products, to Wynnchurch Capital, a middle-market private investment firm.

The sale of Charter Industries highlights Incline’ success in building a North American market leader in edgebanding solutions, nearly tripling revenue, completing two add-on acquisitions, adding two product lines, and strengthening its leadership team with four key senior hires. Under the ownership of Wynnchurch Capital, Charter Industries is well positioned to continue serving customers efficiently while expanding its footprint and operational capabilities across North America.

Sources: PitchBook™, S&P Capital IQ, MelCap Investment Banking knowledge, company websites, and public company filings.

Abdel A. Emam is an Analyst at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].