As the M&A market approaches the final quarter of 2024, dealmakers are actively pursuing opportunities to ensure a strong finish to the year. With the constant volatility of the M&A market, predicting future trends remains an immense challenge. However, news surrounding rate cuts from the Fed might give dealmakers some reasons for optimism as the year draws to a close.

Federal rate cuts could make significant and positive impacts on the M&A market, as lower interest rates create favorable conditions for dealmaking opportunities. They can potentially provide an immediate confidence boost for dealmakers and firms during an otherwise stagnant performance for 2024 acquisitions.

The key factor at play is the reduced cost of debt financing and its material impact on the M&A market, as well as the broader market. Corporations and PE firms now have the opportunity to capitalize on a more favorable lending environment to pursue acquisitions, a variable that has been absent in recent years. To add more fuel to the fire, the Fed has hinted at this being the first of multiple rate cuts to come, providing even more incentive for acquisition activity. These subsequent cuts and refinancing opportunities will free up capital for groups to pursue M&A activity, especially those looking to expand and grow their portfolios before the end of the year. It is an exciting time for dealmakers and the M&A world, as we may begin to see a change in the tide for an industry that has been volatile and unpredictable in the past.

As these rate cuts come into effect, the industry is going to witness a surge in private equity activity and have major impacts across the board.

M&A Market Activity

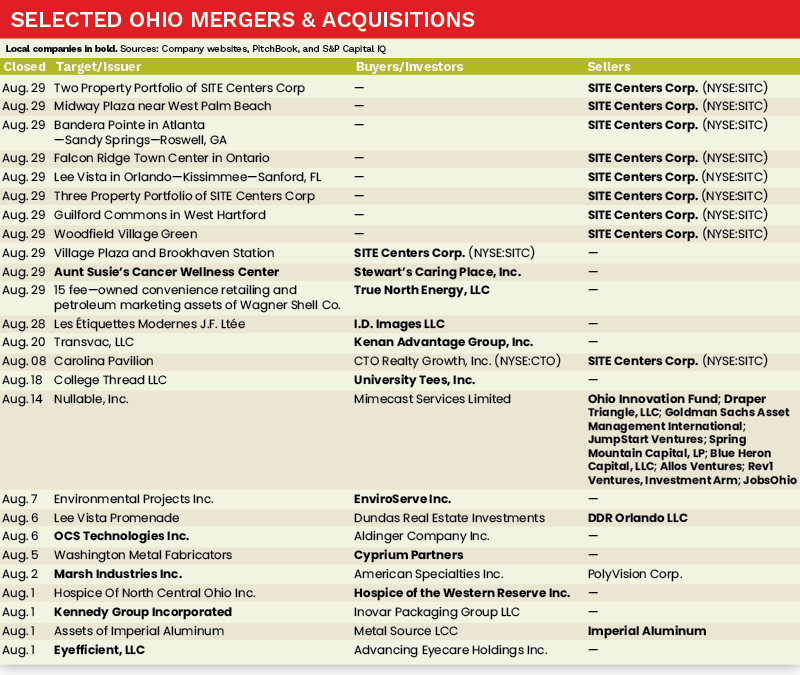

U.S. deal volume decreased by approximately 3.4 percent in August 2024 as compared to the prior month, while YTD volume decreased by approximately 9.8 percent as compared to the prior year. Despite lower levels of M&A activity across the U.S., the market stands poised for a strong finish to the fiscal year, and the Great Lakes region is seeing an early surge and looks to ride the momentum.

Northeast Ohio M&A market deal volume increased by approximately 50.1 percent in August 2024 compared to the prior month, with several noteworthy transactions completed by both strategic acquirers and private equity firms. University Tees, Kenan Advantage Group, True North Energy and Cyprium Partners all completed strategic acquisitions, while SITE Centers Corp. (NYSE: SITC) saw successful exits in the real estate space.

Deal Of The Month

The deal of the month for August 2024 in Northeast Ohio is the acquisition of Environmental Projects Inc. (EPI) by Enviroserve, a national provider of essential environmental and waste management services and a portfolio company of One Rock Capital Partners. EPI is a provider of environmental remediation and waste management services for customers across a diverse set of end markets. The addition of EPI complements Enviroserve’s extensive environmental and waste management services as well as expands their presence into the Northeast markets.

“We are very excited to welcome the EPI team to EnviroServe. This acquisition expands our presence in the Northeast and brings a wealth of experience to our waste-handling operations. The EPI team’s expertise and commitment to safety and excellence will be invaluable as we strive to better serve customers,” stated Ryan Reid, VP of Business Development at EnviroServe. ●

Luke Hippler is an Analyst with MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].