In today’s M&A environment, diligence has become more demanding than ever. Buyers are increasingly sophisticated, lenders are more cautious and regulators are applying greater scrutiny across industries. This increased diligence has created what many dealmakers refer to as the “diligence gauntlet”— a process that is more intensive, wide-ranging and time-consuming than in years past. For sellers, the ability to anticipate this level of scrutiny can be the difference between a deal that closes smoothly and one that drags out longer than expected.

Several factors are driving the heightened pressure around diligence. Tight credit markets have forced lenders to probe more deeply into the quality of earnings, collateral and cash flow sustainability. Regulators have raised the bar around compliance, cybersecurity and ESG reporting. At the same time, both private equity and strategic buyers are submitting more detailed data requests, often reaching into operational and commercial areas that companies may not have historically tracked. All these dynamics mean sellers must be prepared to provide a broader and more granular picture of their business.

The most effective way for companies to manage this process is through preparation. Financial reporting must be organized, reconciled and easy to trace across all reports — from monthly statements to trial balances to audited financials. Beyond the financials, companies should ensure that their internal systems can produce reliable and detailed reporting outputs. These processes and systems will be essential not only for satisfying financial diligence, but also for addressing the broader business diligence requirements of both buyers and lenders.

Legal and compliance readiness is equally critical. Outstanding litigation, lapsed contracts or unclear intellectual property ownership can all derail negotiations if not addressed in advance. Sellers should also ensure corporate records are current, employee agreements are well-documented and regulatory filings are up to date, as buyers increasingly review these areas in detail.

Even with strong preparation, the diligence process can feel overwhelming for management teams. However, by approaching diligence as a strategic process rather than a reactive one, sellers can not only withstand the gauntlet but also use it as an opportunity to build buyer confidence and maximize transaction certainty.

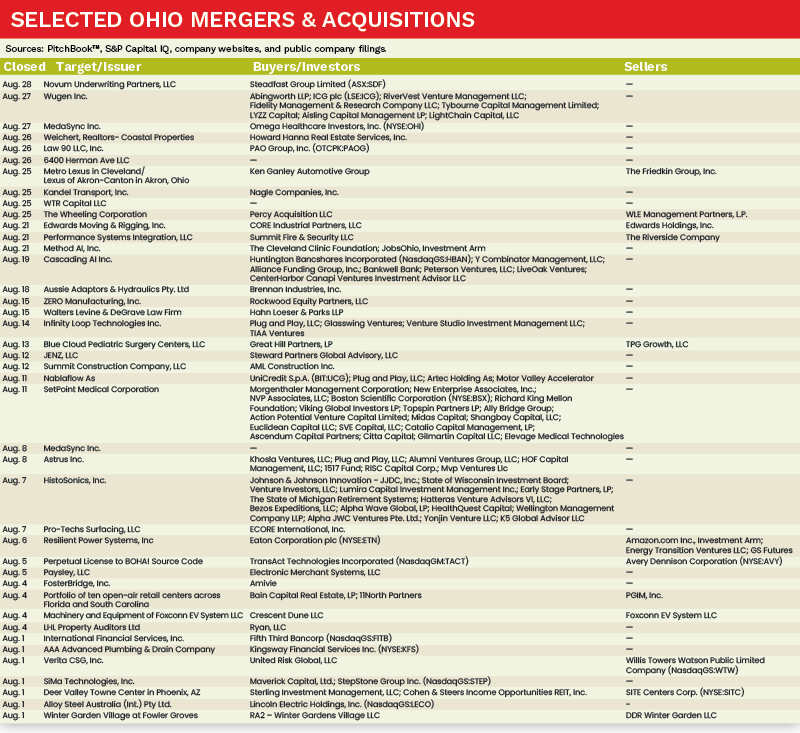

M&A Market Activity

Following a strong July, U.S. deal volume in August 2025 declined 16.4 percent compared to the same period in 2024. Even with a decline, overall activity for 2025 remains well above historical averages, and the outlook for the remainder of the year is encouraging.

In contrast, the Cleveland M&A market recorded a strong August 2025, with transaction volume increasing 36.7 percent compared to July. Both private equity and strategic buyers were active in Northeast Ohio, with notable transactions involving local acquirers such as Eaton Corporation, Lincoln Electric Inc., and The Riverside Company. ●

Sources: PitchBook™, S&P Capital IQ, company websites, and public company filings.

J. Carter Hatina is a Senior Associate at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].