M&A dealmakers have experienced a bumpy ride. Following the post-pandemic boom of deal volume in 2021, the market in subsequent years witnessed an unfortunate decline. Needless to say, the M&A landscape has offered something of a “masterclass” in volatility. There are a handful of factors that have played into the reduction of activity over the past few years, but other positive aspects including dry powder abundance and easing macroeconomic conditions suggest a potential market recovery.

Despite sounding repetitive, it’s worth noting that the current amount of dry powder (committed capital that private equity firms have available for deployment) remains near record highs due to high fundraising and low deployment in recent months. Amid unfavorable interest rates and greater levels of regulatory scrutiny, including a noticeable uptick in the enforcement of antitrust laws, private equity deals have been suppressed in recent years, prompting many firms to focus more on smaller add-on acquisitions. As interest rates continue to sit above desired levels, buyers will endure less potential return and more risk of default on specific investments. An easing lending environment, among other economic factors, will presumably drive larger platform deals, further stimulating deal value and volume.

Other dealmaking factors including potential interest rate cuts and easing inflation, are also encouraging signs that deal volume will pick up during 2024. The pent-up deal demand from private equity investors who have been sitting on the sidelines over the past 12 to 24 months is likely to spur M&A activity for the remainder of the year.

With all of the aforementioned topics influencing the market today, it can be expected that overall deal volume and value will increase throughout 2024 and beyond.

M&A Market Activity

U.S. deal volume increased by approximately 2.5 percent in May 2024 as compared to the prior month, while YTD volume decreased by approximately 16 percent as compared to the prior year. During this market rebound, the low levels of M&A activity have increased the demand of both private equity and strategic acquirers hungry to deploy capital.

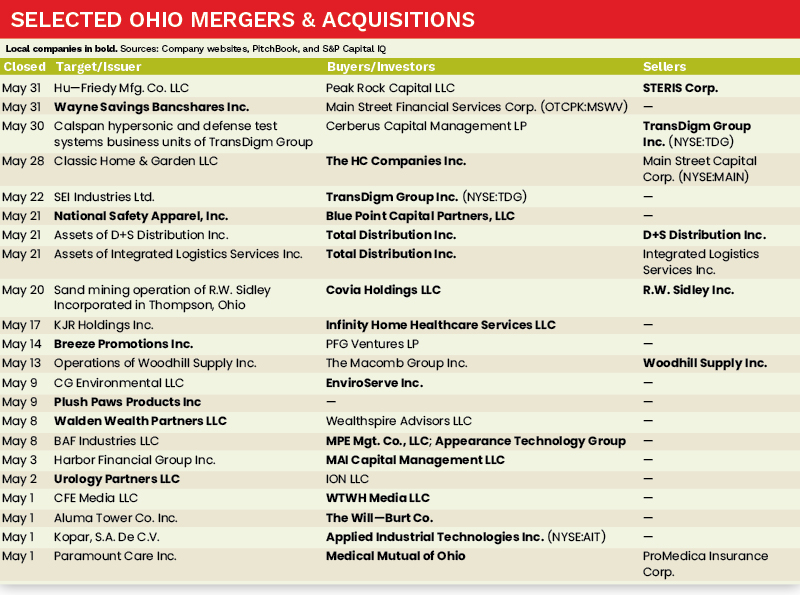

The Northeast Ohio M&A market, deal volume increased by approximately 21 percent in May of 2024 as compared to the prior month with several noteworthy transactions completed by both strategic acquirers and private equity firms. Infinity Home Healthcare Services, Medical Mutual of Ohio, WTWH Media, and The Will-Burt Company all completed strategic acquisitions, while companies like D+S Distribution saw a successful exit in the distribution space.

Deal of the Month

The deal of the month for May 2024 in Northeast Ohio is Blue Point Capital Partner’s acquisition of National Safety Apparel, a privately held manufacturer of American-sewn safety apparel based out of Cleveland, Ohio. National Safety Apparel specializes in workwear including flash suits, face shields, safety vests, suppression blankets, and performance clothing, among other protective clothes and accessories. The addition of National Safety Apparel complements Blue Point’s extensive industrial manufacturing portfolio and expands its product offering with high-performance personal protective equipment and safety products.

“This partnership is a continuation of Blue Point’s history of partnering with local, family-owned businesses. National Safety Apparel’s impressive performance and customer loyalty demonstrate their exceptional market position and quality products. The company is an excellent fit with Blue Point’s manufacturing and safety sector investing experience,” stated Jonathan Pressnell, Partner at Blue Point.

Sources: Company websites, PitchBook, and S&P Capital IQ

Jake Peebles is an Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].