Post-merger integration (PMI) is the stage where a transaction’s strategic vision starts to take shape and the groundwork for long-term value is laid. While deal execution often captures headlines, the success of an acquisition ultimately depends on how well two organizations come together operationally, culturally and strategically.

Successful integrations begin long before closing. The most effective acquirers treat integration planning as a parallel workstream to diligence, aligning leadership around strategic objectives and defining what “success” looks like early on. Integration teams that are embedded in deal discussions from the start are better positioned to anticipate potential friction points, prioritize critical systems and processes, and ensure alignment regarding customer and employee experience.

Cultural alignment is often the most underestimated component of PMI. Beyond systems and structures, people integration determines how quickly teams can work toward shared goals. Clear communication, transparent leadership, and deliberate culture-building help maintain morale and productivity through periods of uncertainty. Organizations that invest in cultural onboarding typically see faster stabilization and strong long-term performance.

Operational discipline is equally vital. Establishing a detailed integration roadmap covering technology, finance, operations and governance enables accountability and keeps post-close execution on track. Leveraging data and analytics can help monitor synergy realization and identify areas where value capture may lag.

The integration journey doesn’t end once systems are combined or reporting lines are redrawn. It continues as teams align around shared goals, refine processes and embed new ways of working. Firms that foster collaboration, maintain clear governance and actively manage change are more likely to sustain the momentum that turns deal rationale into long-term value creation.

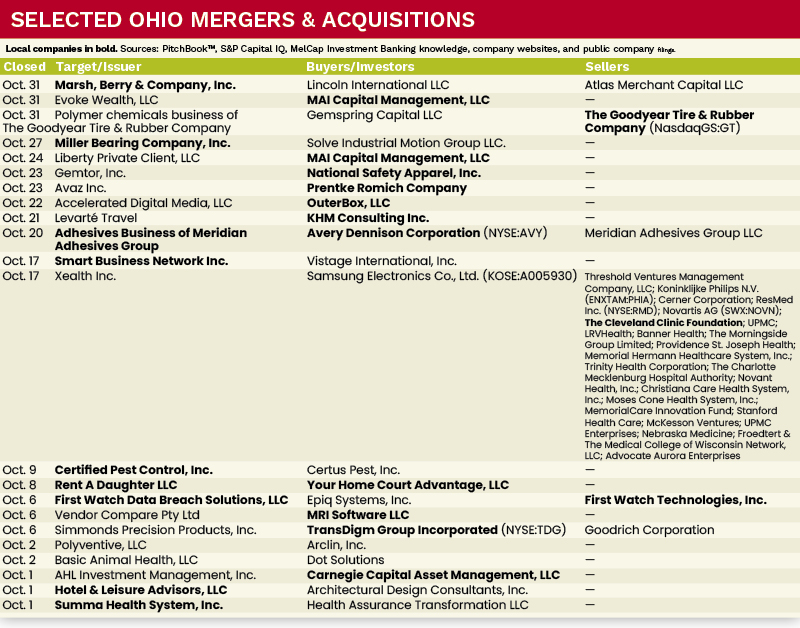

M&A Market Activity

U.S. deal volume in October 2025 softened by 22.7 percent as compared to October of the prior year, with YTD volume just 2.7 percent below the total transactions for the prior YTD period. Conversely, aggregate deal value has climbed meaningfully in 2025, supported by a renewed appetite for high-quality assets and a rebound in strategic activity. Strong participation from both corporate acquirers and private equity investors has driven this momentum, signaling growing confidence in long-term growth sectors and more deliberate capital deployment.

The Cleveland M&A market experienced a 10 percent increase in activity in October 2025 compared to the same period in 2024. Moreover, notable Cleveland-based companies, such as Avery Dennison, TransDigm, and Prentke Romich Company all completed strategic acquisitions, while Miller Bearing Company and Summa Health System transitioned to new ownership, highlighting the region’s dynamic deal-making environment.

Deal of the Month

On October 17, 2025, Smart Business Network (SBN), a Cleveland-based company that has served the business community for more than 35 years through its Smart Business publications and live events, completed its sale to Vistage, the world’s largest CEO coaching and peer advisory organization.

Together, SBN and Vistage will deliver a more robust platform for CEOs and business owners navigating transactions, leveraging SBN’s live events and editorial content as a powerful forum for connection and insight.

“For more than 35 years, SBN has built a strong foundation rooted in relationships and community,” said Fred Koury, the company’s Co-founder, President and CEO. “Over that time, we’ve developed a strong track record of understanding middle-market executives and providing them with the insights, advice and strategies to be successful. Joining forces with Vistage will allow us to strengthen our commitment to these leaders.”

Vistage CEO Sam Reese added, “SBN’s Dealmakers events and editorial content provide a powerful platform for connecting leaders during one of the most important phases of their business journey.”

The acquisition reinforces Vistage’s strategic mission of being the world’s most trusted resource for CEOs of small and midsize businesses, helping them make better decisions, become better leaders, and deliver better outcomes. By integrating SBN’s event series and community‑based programming, Vistage strengthens its footprint in local markets and deepens its transaction‑focused capabilities. ●

Sources: PitchBook™, S&P Capital IQ, MelCap Investment Banking knowledge, company websites, and public company filings.

Abdel A. Emam is an Analyst at MelCap Partners LLC, a middle-market investment banking advisory firm.

For more information on MelCap Partners, please visit www.melcap.com or email [email protected].