The 2025 M&A landscape continues to be shaped by volatility and disruption driven by shifting foreign trade policies. Despite these headwinds, companies are demonstrating resilience, while dealmakers exhibit heightened creativity and an opportunistic mindset, adeptly navigating evolving market dynamics to uncover value and drive strategic growth.

Carve-out transactions, where a parent company sells a division, subsidiary, or business unit, have become an increasingly common feature of the lower middle market. For both buyers and sellers, carve-outs can unlock meaningful strategic value, though they introduce distinct operational and structural complexities. Executing a successful carve-out requires more than simply separating assets; it demands a well-defined strategy that ensures operational independence and positions both entities for sustained growth. In many cases, divesting a non-core unit both frees up resources and enhances the performance and value of the remaining business by enabling management to sharpen its focus on core priorities.

A major challenge in carve-outs is managing shared services such as IT, HR, finance and supply chain. Building operational independence should be a top priority from the outset. Buyers must determine whether the carved-out business can function as a standalone entity or whether transition service agreements (TSAs) will be necessary. While TSAs can provide a temporary bridge, they may also become a hidden risk if timelines, costs and exit terms are not tightly defined.

Financial clarity is another cornerstone. Carve-out financials often lack the rigor of standalone statements, creating uncertainty around historical performance. Establishing accurate and supportable financials is critical to ensure buyers can make informed decisions and sellers achieve a fair valuation. Without this, hidden liabilities or misallocated shared costs can quickly erode deal value. Additionally, legal and regulatory considerations add further complexity. Environmental liabilities, pension obligations and employee transfers can all create post-closing challenges if not properly addressed during diligence and negotiation. Comprehensive reviews, paired with well-structured purchase agreements, are essential to allocating these risks appropriately.

Carve-outs should not be approached as simple divestitures. They are multifaceted corporate separations that require early planning, financial transparency and precise execution. When carefully structured, they not only avoid hidden risks but also create long-term strategic advantage.

M&A Market Activity

In September 2025, U.S. deal volume declined 24.8 percent compared to September 2024. Despite this slowdown, M&A activity is expected to accelerate, supported by stable financing conditions, easing recession concerns and stronger strategic priorities. Additional Federal Reserve rate cuts are anticipated to lower capital costs, bolster confidence and make investments more attractive, providing renewed momentum for the M&A market.

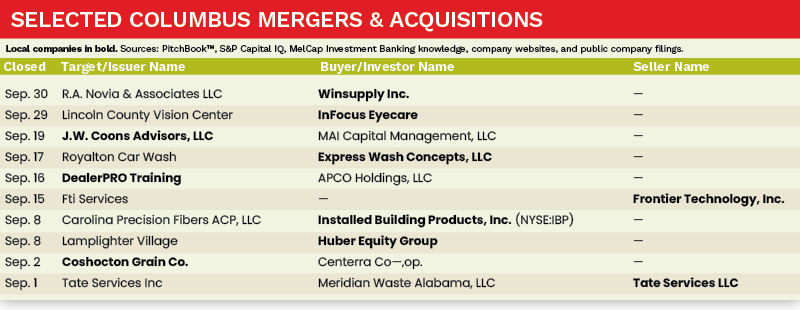

The Columbus M&A market experienced a 42.9 percent increase in activity in September 2025 compared to the same period in 2025. Moreover, several notable transactions were completed by both strategic acquirers and divestors, underscoring the region’s active deal-making environment. Installed Building Products (NYSE: IBP), Winsupply Inc., and InFocus Eyecare executed strategic acquisitions, while Frontier Technology, Inc. completed a successful divestiture during this period.

Deal of the Month

Installed Building Products, Inc. (IBP) is an Ohio-based installer of insulation and complementary building products. On September 8, 2025, IBP announced the acquisition of Carolina Precision Fibers ACP, LLC (CPF), doing business as Carolina Precision Fibers. Located in Ronda, North Carolina, CPF manufactures cellulose-based insulation for homes, hydromulch for erosion control, and composite materials used in industrial applications.

CPF expands IBP’s access to an environmentally responsible and versatile product, which serves as an alternative to fiberglass insulation in residential applications and several innovative commercial and industrial applications as well.

Sources: PitchBook™, S&P Capital IQ, MelCap Investment Banking knowledge, company websites, and public company filings.

Domenick Cristino is a Vice President with MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].