As we turnover into a new year, and look to hit the ground running in 2026, financial service providers, M&A advisers, strategic and financial acquirers, privately-held business owners, and their next-of-kin, will be “front and center” as the massive intergenerational transfer of wealth known as “The Great Wealth Transfer” continues to unfold in the United States and globally. Baby Boomers continue to age out of the workforce and the substantial wealth that the generation has accumulated, including privately-held businesses, will need to transition to new ownership. This paradigm is expected to have a significant impact on M&A activity, as well as exit planning in general, over the next several years, if not decades.

According to data from the UBS Global Wealth Report 2025, Baby Boomers are estimated to hold more than half of America’s $163.1 trillion wealth while making up only one fifth of the country’s current population. Furthermore, the Baby Boomers are expected to be almost entirely phased out of the nation’s labor force by the year 2035. As a result, an increased emphasis is being placed on exit planning by business owners and their financial advisers, which should fuel deal activity, as business owners look to retire and transition their businesses.

Most business owners participating in the middle-market typically have a large portion of their wealth tied up in the business. Therefore, as they continue to focus on preparing for retirement, most owners will look towards monetizing the business through an outright sale, particularly if they have no family in the business. On the other side of the coin, both strategic and financial acquirers continue to look to acquisitions as a powerful way to drive shareholder value — and have the wherewithal to make meaningful acquisitions. As of Q4 2025, non-financial S&P 500 companies held aggregate total cash of nearly $1.9 trillion on its balance sheets, which will be used for continued investment and M&A. Conversely, U.S. private equity groups have an estimated $2.2 trillion of purchasing power, which includes $1 trillion of dry powder and $1.2 trillion of estimated available leverage.

For the first time since being tracked by MelCap, potential acquirers have an estimated combined total purchasing power of more than $4 trillion. Financial and strategic acquirers’ ability to support a transformational acquisition has led to increased competition for high-quality businesses, which in turn has driven lofty valuations. As a testament to this increase in valuations, in 2H 2025, the average disclosed deal value in the United States surpassed $500 million — a key indicator that privately-held businesses are commanding higher valuations than ever before — yielding more substantial proceeds to ownership.

The majority of U.S. middle market businesses are owned by the aging Baby Boomers who are looking to either transition business ownership to the next generation or fully monetize the business via an outright sale, and C-suite executives are continuing to pursue scale & drive shareholder value. This should create an exciting and robust M&A outlook over the next several years. Only time will tell.

M&A Market Activity

U.S. deal volume in December 2025 reached its highest monthly total in December since 2021 — as its total of nearly ~1,300 closed M&A transactions increased by 15.8 percent as compared to November 2025, and 14.1 percent as compared to December of 2024.

In terms of total annual deal volume, 2025 eclipsed 13,400 closed M&A transactions, which represents an annual increase of more than 6.5 percent as compared to 2024, and is the highest annual total since 2022. Furthermore, total closed M&A transaction volume over both 2H 2025, and Q4 2025, reached its highest point since 2021 — a very encouraging indicator of a strong deal landscape heading into 2026.

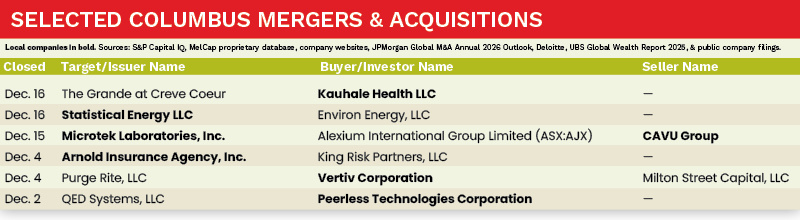

The Columbus M&A market, while modestly down in Q4 2025 (less than 5 percent as compared to Q4 2024), experienced a significant increase in deal activity in 2025, as closed deal volume increased more than 16 percent, as compared to the full year in 2024. Moreover, notable Pittsburgh-based companies, such as Kauhale Health, Peerless Technologies Corporation, and Vertiv Corporation, each completed strategic acquisitions.

Deal of the Month

Vertiv Holdings Co (NYSE: VRT), based in Westerville, Ohio, is a global provider of critical digital infrastructure, today announced the successful completion of its previously reported intent to acquire Purge Rite Intermediate LLC, a leading provider of mechanical flushing, purging and filtration services for data centers and other mission-critical facilities. The approximately $1 billion acquisition enhances Vertiv’s thermal management services capabilities and strengthens its position as a global leader in next-generation thermal chain services for liquid cooling systems.

PurgeRite, formerly owned by Texas-based Milton Street Capital, is headquartered in Houston, Texas and has established itself as an industry leader in mechanical flushing, purging and filtration for mission-critical data center applications, including strong relationships with hyperscalers and Tier 1 colocation providers. PurgeRite’s services will join forces with Vertiv’s existing liquid cooling offerings to deliver end-to-end thermal management solutions from facility to room and row to rack.

“We are excited to officially welcome PurgeRite to Vertiv, expanding to deepen our fluid management services capabilities,” said Gio Albertazzi, CEO at Vertiv. “PurgeRite’s specialized expertise in fluid management services complements our existing portfolio and enhances our ability to provide end-to-end product and service support for customers’ high-density computing and AI applications where efficient thermal management is critical to performance and reliability.”

Sources: S&P Capital IQ, MelCap proprietary database, company websites, JPMorgan Global M&A Annual 2026 Outlook, Deloitte, UBS Global Wealth Report 2025, & public company filings.

Anthony A. Melchiorre is a Managing Director & Principal at MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].