Artificial intelligence (AI) is reshaping the M&A landscape, improving execution speed, accuracy and analytical depth. As dealmaking becomes increasingly complex and data-intensive, AI’s adoption is accelerating across due diligence, valuation, target identification and post-merger integration.

In diligence, AI tools are enhancing document review, risk identification and contract analysis. Natural language processing allows large volumes of legal, operational and financial data to be processed in a fraction of the time required by traditional methods. This efficiency reduces both deal timelines and the likelihood of oversight.

For target screening and valuation, machine learning models are enabling faster analysis of vast market data sets, identifying patterns that may not be visible through conventional financial modeling. Private equity firms and strategic acquirers are leveraging these insights to refine pipeline development and assess synergies with greater precision.

AI is also playing a critical role in post-merger integration. Predictive analytics help anticipate integration challenges, model workforce attrition and optimize go-forward organizational structures. This foresight contributes to improved value capture and smoother transitions post-close.

Despite its utility, AI is not a substitute for strategic judgment. Limitations in data quality, explainability and context awareness necessitate human oversight. This is particularly relevant for smaller-sized deals with less sophisticated systems and lower transaction volumes from which to perform analysis and form conclusions.

Effective application of AI on deals is not a one-size fits all approach, with thoughtful deal-specific strategy required. Successful implementation also requires coordination between deal teams, technology providers and functional stakeholders.

As AI tools continue to mature, their impact on M&A efficiency and competitiveness will likely expand. Firms that adopt and adapt effectively will be positioned to drive better outcomes across the transaction lifecycle.

M&A Market Activity

U.S. deal volume in June 2025 rose by 1.9 percent as compared to June of the prior year, but YTD volume still lagged behind the prior YTD period by 2.6 percent. Conversely, deal value in H1 2025 outperformed the prior year by 12.5 percent. An increase in mega-deals, by both strategic and PE-backed platforms, drove the increase in deal value, with a large amount of the enterprise value related to AI and tech-focused acquisitions.

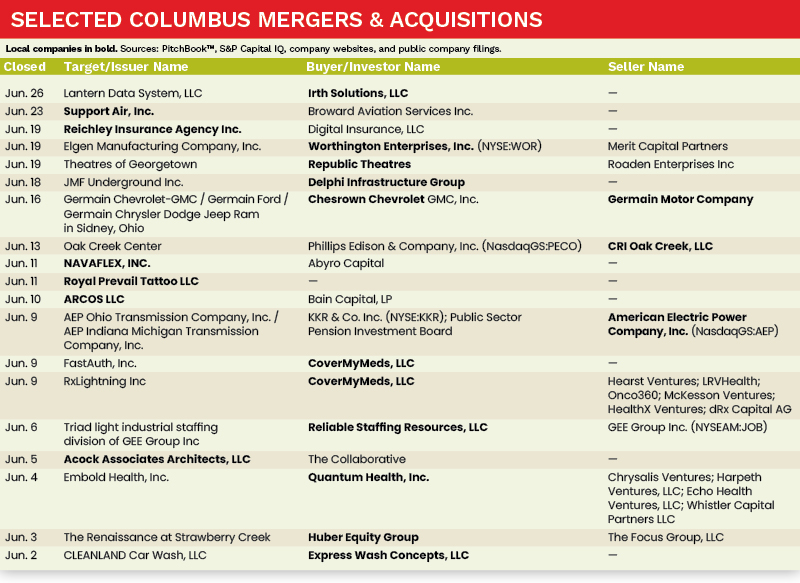

The Columbus M&A market experienced June deal activity that was flat as compared to the prior month, and resulting in YTD deal volume growth of 5 percent. Transactions during the period were largely strategic in nature and included acquisitions by Worthington Enterprises, Delphi Infrastructure Group, Quantum Health, CoverMyMeds, and Express Wash Concepts, as well as exits by NavaFlex, ARCOS, and Reichly Insurance Agency.

Deal of the Month

On June 19, 2025, Columbus-based Worthington Enterprises, a designer and manufacturer of market-leading brands, announced its acquisition of Elgen Manufacturing (Elgen). Elgen is a market-leading designer and manufacturer of HVAC parts and components, ductwork and structural framing primarily used in commercial buildings throughout North America.

Joe Hayek, president and CEO of Worthington Enterprises, said, “The addition of Elgen aligns closely with our strategy to build and acquire businesses with leadership positions in niche markets. Elgen’s manufacturing processes, go-to-market strategies and end markets mirror ours, creating meaningful opportunities for synergies and growth. We are excited to welcome the Elgen team to Worthington Enterprises and look forward to growing together as their 250 employees become part of our people-first, performance-based culture.”

Elgen will become part of the Building Products segment at Worthington Enterprises that includes a portfolio of critical building systems and components for heating, cooling, construction and water applications, as well as architectural and acoustical grid ceilings and metal framing and accessories. ●

Sources: PitchBook™, S&P Capital IQ, company websites, and public company filings.

Daniel M. Bowman is a Director and Principal at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].