In the ever-changing and often volatile world of mergers and acquisitions, timing is everything. After a slow start to the year, the second half of 2025 is shaping up to be a potential turning point for M&A activity. Deal pipelines are expanding, private equity firms hold record dry powder and economic uncertainty is beginning to ease. These factors are setting the stage for a strong close to the 2025 M&A cycle.

Renewed optimism is sweeping the dealmaking landscape, as 2025 data reveals significant year-over-year increases in marketed deals across health care, business services and consumer sectors. Buyers and sellers are returning to the table, eager to close deals and capitalize on more favorable market conditions.

Private equity firms are sitting on historically high levels of unspent capital. While tariffs and economic uncertainties slowed M&A activity earlier in the year, these firms now face both tremendous opportunity and mounting pressure to deploy capital and deliver strong returns. Paired with ongoing improvements in financial conditions, PE-backed transactions are expected to experience a notable resurgence across multiple sectors.

Several key financial indicators — including cooling inflation and signals of potential rate cuts from the Federal Reserve — are expected to ease borrowing costs. At the same time, subsiding tariff negotiations and increased policy clarity are helping to restore buyer confidence, laying the foundation for renewed M&A activity. Together, these developments are creating a more favorable environment for both strategic acquisitions and leveraged buyouts.

Looking ahead, all signs point toward a meaningful acceleration in M&A activity throughout the remainder of 2025. Deal pipelines remain strong across a variety of sectors, capital is primed for deployment and the broader economic trends are shifting to support an active environment. With both buyers and sellers re-entering the market with improved confidence, the second half of the year is well-positioned to deliver an impressive performance of deal making activity.

M&A Market Activity

In July 2025, U.S. deal volume experienced an increase of 6.5 percent from July of the prior year, and deal volume rose 20.7 percent as compared to June 2025. With ongoing economic stabilization and improving market sentiment, M&A is seeing a resurgence in activity in anticipation of a strong close to the 2025 fiscal year.

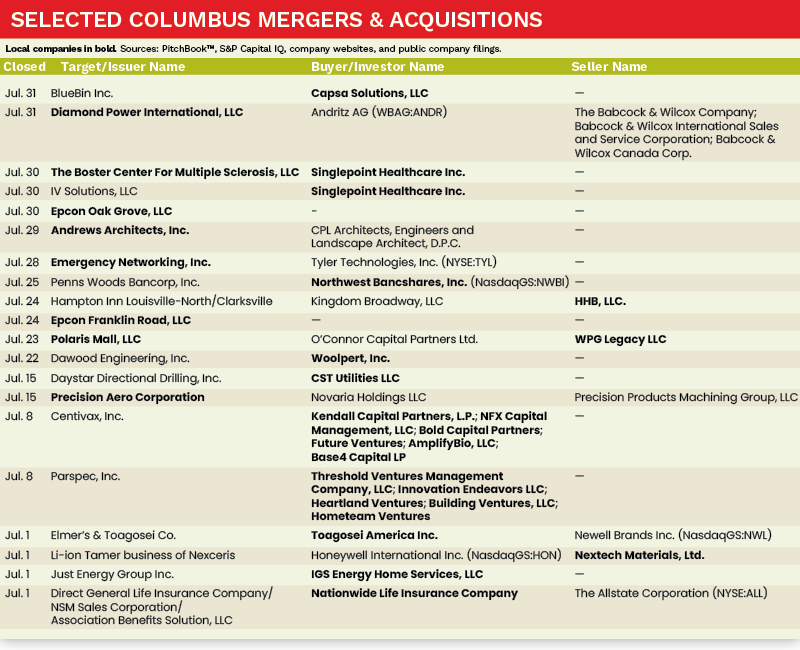

The Columbus M&A market experienced a 5.3 percent increase in deal volume compared to July 2025. Columbus based companies Capsa Solutions LLC, Singlepoint Healthcare, and CST Utilities all completed acquisitions, while Diamond Power International and Andrews Architects Inc., were acquired in the month of July.

Deal Of The Month

On July 1, 2025, Columbus-based IGS Energy, a leading supplier of natural gas and electricity, announced its acquisition of Just Energy. Just Energy is a trusted leader in the retail energy sector, and the acquisition creates one of the largest energy retailers in North America.

Scott White, President and CEO of IGS Energy, said, “We are delighted to officially welcome Just Energy and proud of the hard work and collaboration all the teams put in to make this new partnership a reality. Just Energy’s highly successful origination channels, marquee retail relationships, and deep industry expertise are a perfect complement to our capabilities. Together, we’re better positioned to seize new growth opportunities, particularly in Texas.” ●

Sources: PitchBook™, S&P Capital IQ, company websites, and public company filings.

Luke T. Hippler is an Analyst at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].