As the M&A market approaches the final quarter of 2024, dealmakers are actively pursuing opportunities to ensure a strong finish to the year. With the constant volatility of the M&A market, predicting future trends remains an immense challenge. However, news surrounding rate cuts from the Fed might give dealmakers some reasons for optimism as the year draws to a close.

The impending federal rate cuts could make significant and positive impacts on the M&A market, as lower interest rates create favorable conditions for dealmaking opportunities. They can potentially provide an immediate confidence boost for dealmakers and firms during an otherwise stagnant performance for 2024 acquisitions.

The key factor at play is the reduced cost of debt financing and its material impact on the M&A market, as well as the broader market. Corporations and PE firms now have the opportunity to capitalize on a more favorable lending environment to pursue acquisitions, a variable that has been absent in recent years. To add more fuel to the fire, the Fed has hinted at this being the first of multiple rate cuts to come, providing even more incentive for acquisition activity. These subsequent cuts and refinancing opportunities will free up capital for groups to pursue M&A activity, especially those looking to expand and grow their portfolios before the end of the year. It is an exciting time for dealmakers and the M&A world, as we may begin to see a change in the tide for an industry that has been volatile and unpredictable in the past.

As these rate cuts come into effect, the industry is going to witness a surge in private equity activity and have major impacts across the board.

M&A Market Activity

U.S. deal volume decreased by approximately 3.4 percent in August 2024 as compared to the prior month, while YTD volume decreased by approximately 9.8 percent as compared to the prior year. Despite lower levels of M&A activity across the U.S., the market stands poised for a strong finish to the fiscal year, and the Great Lakes region is seeing an early surge and looks to ride the momentum.

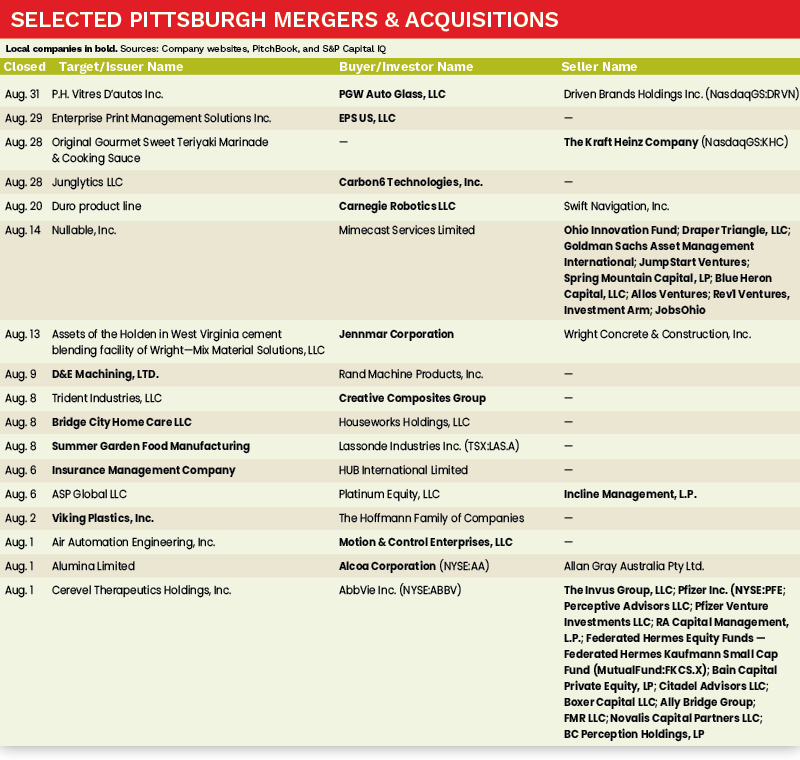

The Pittsburgh M&A market volume deal volume increased by approximately 9.1 percent in Q3 of 2024 as compared to Q1, with several noteworthy transactions completed by both strategic acquirers and private equity firms. PGW Auto Glass, Carnegie Robotics, Creative Composites Group, and Motion & Control Enterprises all completed strategic acquisitions, while Incline Equity Partners saw a successful exit in the medical device space.

Deal of the Month

The deal of the month for May 2024 in Pittsburgh is the Hoffman Family of Companies acquisition of Viking Plastics, a privately held leading innovator in custom plastic molding solutions. Viking Plastics specializes in the development and production of high-quality sealing closures for automotive and HVAC applications. The addition of Viking Plastics strengthens The Hoffman Family of Companies extensive portfolio of manufacturing businesses across North America.

“Viking Plastics has laid the groundwork essential for expansion, supported by its robust team, advanced manufacturing capabilities and distinctive commitment to culture. We are excited to enhance our investment in the U.S. manufacturing sector with such a transformative organization,” stated Geoff Hoffman, Co-CEO of Hoffman Family of Companies.

Luke Hippler is an Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].