Sports enthusiasts can attest, there are few scenarios more thrilling than a 4th quarter comeback. And no NFL quarterback has led more 4th quarter comebacks than future Hall of Famer, Tom Brady. A brief look at history would indicate that total U.S. deal volume and Tom Brady have something in common: completing a fourth quarter comeback.

In four of the last five years, total U.S. M&A deal volume in the fourth quarter has exceeded total deal volume in each of the preceding three quarters, respectively. Fiscal year-ends, budgeting cycles, bonus incentives, tax considerations, achievement of annual targets, and the race to lock in financing before year-end are all factors consistently contributing to the uptick that often makes the 4th quarter the most promising quarter in terms of total deal closures.

As business executives plan for the year ahead, the urgency to close before year-end is frequently fueled by a desire to project the holistic operations of a company for the following fiscal year and beyond. Additionally, the aforementioned stakeholders are often compensated by way of performance-based incentives associated with a deal closure. From a corporate level, companies may be enticed to exercise certain tax-related advantages associated with a sale, or purchase, of a company before the New Year’s Eve ball drops. Similarly, companies will push for achievement of annual targets where, naturally, the 4th quarter deadline creates a sense of urgency. For a varying degree of the aforementioned reasons, it is not uncommon to see a push for transaction finalization as quarters come to a close.

Sports enthusiasts, business owners and M&A executives alike all love the thrill of a 4th quarter comeback, which based on the total U.S. transaction volume for the month of October 2023, the fourth quarter of 2023 appears to be yet another case study in the fourth quarter comeback saga.

M&A Market Activity

Deal volume within the U.S. for the October 2023 declined by 19.2 percent when compared to the same period in 2022. Recent deal volume within the U.S., however, increased by 15.2 percent for October 2023 when compared to the prior month.

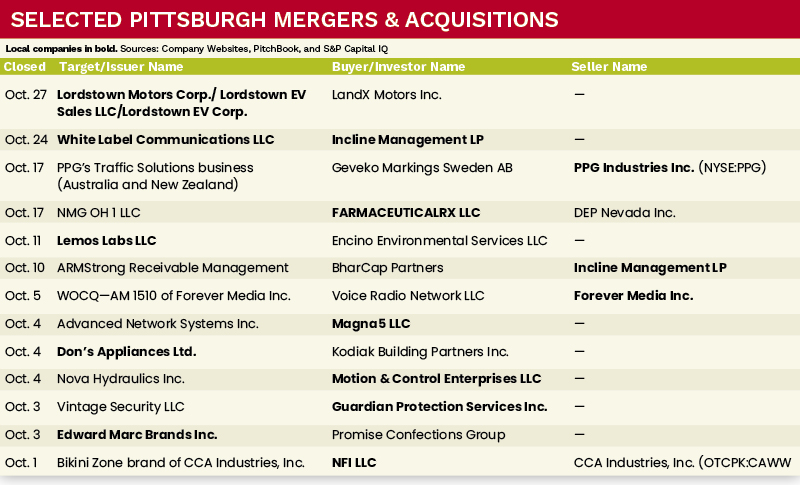

The Pittsburgh, Pennsylvania, M&A market continued to see strong deal volume in October 2023 with deal volume increasing by 18.2 percent when compared to September 2023. October 2023 saw several noteworthy transactions in the Greater Pittsburgh region, with Guardian Protection Services, Magna5 and Motion & Control Enterprises, all companies with a Greater Pittsburgh presence, completing acquisitions within the month.

Deal of the Month

Incline Equity Partners acquired White Label Communications (WLC), a provider of private label communication solutions to managed service providers.

Both based in Pennsylvania, the partnership allows for Incline to offer Atlas, a proprietary technology platform that enables managed service providers to provide solutions to their customers via core operations such as sales, finance and reporting. Atlas also allows for the deployment of private-labeled customer communication tools such as VoIP, video conferencing, SMS and chat to their clients (which tend to be small and medium-sized businesses).

Incline is a private equity firm dedicated to investing across the middle market. Victor Martinell, managing director at Incline, said of the deal, “We are excited to support Tom Joseph and the WLC team who have built a differentiated and diversified platform. To broaden the company’s private label solutions set, we plan to add complementary products through strategic acquisitions. The goal is to position our MSP partners to be full-service providers capable of delivering a complete set of essential solutions for their small and medium-sized business customers.” ●

David Shibley is an analyst with MelCap Partners, LLC, a middle-market investment banking and advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].