Following a couple of strong years of M&A activity in terms of both volume and value, the broader M&A market has battled with the newfound challenges of obtaining financing, as well as its elevated associated costs, throughout 2023. As a result, dealmakers have become more selective acquirers in the M&A market by placing a greater emphasis on value creation and transformational growth in comparison to years past, which saw megadeals as headlines seemingly every month. While dealmakers, both corporations and private equity firms alike, navigate the current macroeconomic conditions impacting dealmaking activity, optimism remains high for strong transaction activity in the near future as M&A becomes a more pivotal growth strategy for businesses.

While megadeals have become scarcer in today’s economic landscape, M&A activity for smaller deals within the middle market have been able to navigate the aforementioned financing challenges and have become more favorable for both corporations flush with cash and private equity firms seeking strategic bolt-on acquisitions. From a competitive perspective, corporations with a significant war chest and robust integration processes have gained the advantage over private equity firms given corporations’ ability to realize synergistic benefits and avoid a tough financing environment. Private equity firms with a proven playbook and certitude for a specific business or industry remain aggressive throughout the acquisition process.

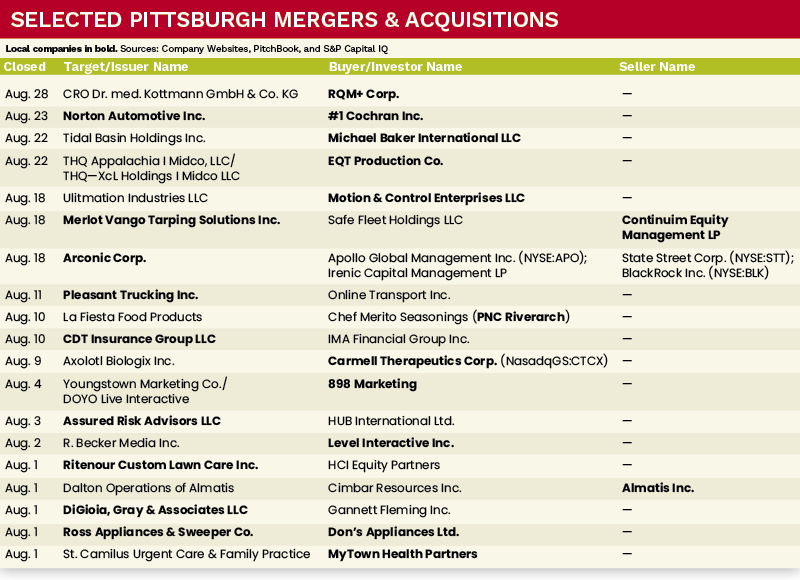

M&A Market Activity

Deal volume within the U.S. for August 2023 declined by 26.9 percent when compared to the same period in 2022. Deal volume, however, within the U.S. increased by 19.8 percent for August 2023 when compared to the prior month.

The Pittsburgh M&A market continued to see strong deal volume in August 2023 with deal volume increasing by 33.3 percent when compared to July 2023. August 2023 saw several noteworthy transactions in the Pittsburgh area, with Ritenour Custom Lawn Care, PNC Riverarch and Motion & Control Enterprises, all companies with a Greater Pittsburgh area presence, completing acquisitions within the month.

Deal of the Month

Gannett Fleming Inc., a provider of engineering and infrastructure solutions, completed the acquisition of DiGioia, Gray & Associates LLC. This acquisition is a testament to GFI’s commitment to deepen its existing transmission and substation engineering offerings to serve power and utility clients on a larger scale.

“For over 100 years, Gannett Fleming has helped our clients develop modern infrastructure solutions that span transportation, electrification and water management. The acquisition of DiGioia Gray will add to our portfolio of differentiated, technology-enabled solutions, all while supporting significant drivers of grid and energy resilience,” said Bob Scaer, CEO of Gannett Fleming Inc. “We couldn’t be more excited to partner with the DiGioia Gray team.” ●

Al Melchiorre is president and CEO and Jake Peebles is anaAnalyst with MelCap Partner, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected] or [email protected].