Today’s economic climate presents a complicated M&A landscape for business owners looking to sell their business. Economic uncertainty stemming from the COVID-19 pandemic and other geopolitical factors has led to volatility in financial markets, driving buyers to invest more cautiously, which in turn leads to longer deal cycles and heightened due diligence requirements. Further contributing to the economic uncertainty and complexities of the M&A market is the upcoming and pivotal election, and with that, the proposed tax code reformations as part of President Joe Biden’s FY 2025 budget.

Understanding the tax implications is paramount for business owners selling their business, as taxes often represent one of the largest expenses in any business transaction, particularly in the sale of a business. High tax burdens can diminish the perceived value of the transaction and influence owners’ willingness to proceed. Those business owners have turned their attention to Biden’s proposed $7.3 trillion budget, specifically concerning the proposed hike in the long-term capital gains tax code.

Biden’s proposed tax hike on long-term capital gains has sparked much debate. Under the president’s plan, individuals earning more than $1 million of taxable income would see their long-term capital gains tax rate nearly double, from the current 20 percent to 39.6 percent (excluding net investment income tax rate of 3.8 percent), effectively aligning it with the top income tax rate. While this proposal aims to address various income inequalities, this significant tax hike will broadly impact business owners looking to sell their business.

Business owners will continue monitoring the potential changes in the tax policy to appropriately plan for and maximize the value of their exit strategies. The market has seen a willingness of buyers to work with business owners to take proactive steps to minimize those business owners’ tax liabilities. In doing so, owners can preserve more of the sale proceeds for their personal financial goals, whether it be retirement, investment in new ventures, or real estate planning purposes. While numerous intricacies and discussion lie ahead regarding the forthcoming FY 2025 budget, a thorough understanding of the tax implications for owners selling their business is essential for maximizing value and achieving their long-term financial objectives.

M&A Market Activity

U.S. deal volume increased by approximately 1.4 percent in April 2024 as compared to the prior month, while YTD volume decreased by approximately 17 percent as compared to the prior year. Although the M&A market has not yet fully rebounded to pre-pandemic levels, the lower levels of M&A activity have created pent-up buyer demand and a buildup of seller assets with private equity firms and strategic acquirers eager to deploy significant capital for high-quality assets.

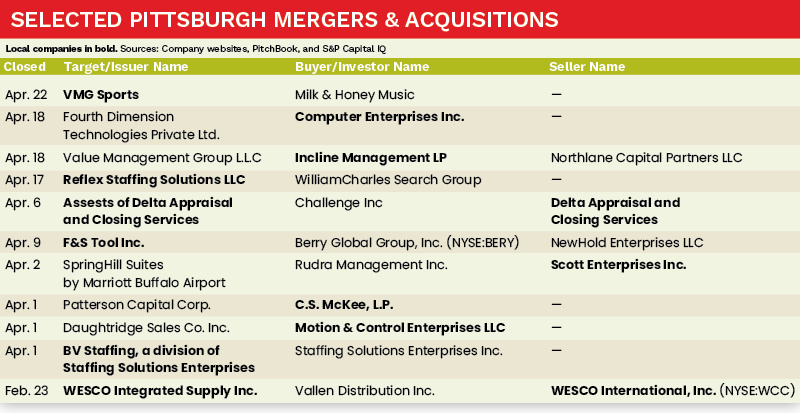

The Pittsburgh M&A market deal volume increased by approximately 10 percent in April 2024, as compared to the prior month, with several noteworthy transactions completed by both strategic acquirers and private equity firms. Computer Enterprises, C.S. McKee, and Motion & Control Enterprises all completed strategic acquisitions, while companies such as Reflex Staffing Solutions saw successful exits in the staffing solutions space.

Andrew Chalhoub is a Senior Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].