As interest rates and borrowing costs move in parallel, buyers are faced with the challenge of navigating increasing costs of debt to finance acquisitions, especially in deals where the seller has experienced significant growth in recent years or in acquisitions requiring sufficient working capital. In such scenarios, buyers may turn to an earnout, a seller’s note, or a combination of both alternative financing options to offer a higher enterprise value and prevail in a competitive bidding process.

Earnouts have become particularly appealing as they allow buyers to structure a portion of the purchase price based on the target company’s future performance. Instead of carrying a higher upfront cost of debt burdened by elevated interest rates, the buyer can commit to additional payments at a later day that will be contingent upon achieving specific post-acquisition financial targets. This financial structure also incentivizes sellers to actively support the post-acquisition integration and performance of the company, as their future payout is linked to the business’ success.

Similarly, seller notes have gained popularity in the face of increasing interest rates. Sellers may be more willing to accept deferred payments in the form of a seller’s note to gain additional purchase price, prevent purchase price reductions, or generate passive income through a favorable interest rate. For the buyer, the seller’s note can delay payment obligations to a later date, easing the immediate financial burden and improving operational cash flow for immediate growth projects. This approach aligns the interests of the buyer and seller, enabling the seller to secure a higher overall deal value while reducing the buyer’s immediate cash outlay.

These financing mechanisms help buyers and sellers navigate the challenges posed by higher borrowing costs and valuation gaps, fostering collaboration and risk-sharing to achieve successful M&A outcomes.

M&A Market Activity

U.S. deal volume continued to underperform previous periods with activity decreasing by 12.8 percent from June 2023 to July 2023, and TTM volume decreasing by 27.6 percent as compared to the same period through July 2022.

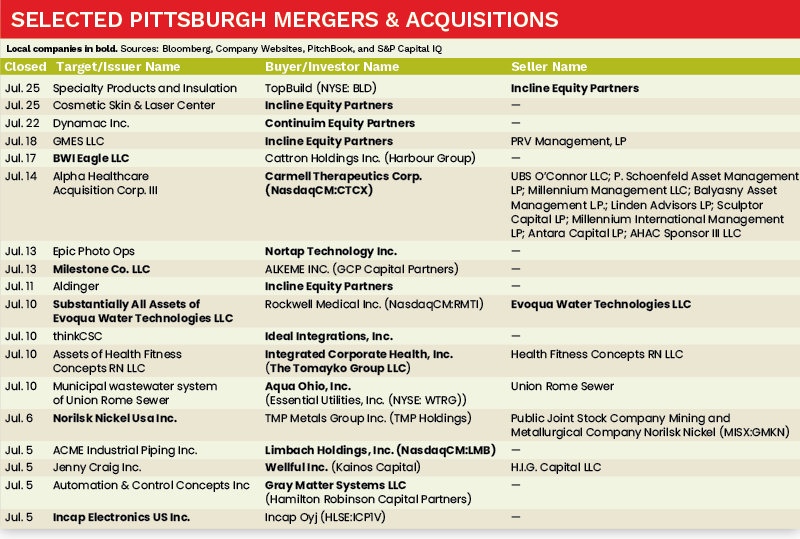

M&A deal volume in the Pittsburgh region in YTD July 2023 observed an increase of 8.3 percent in comparison to YTD July 2022. To that end, July 2023 saw several noteworthy transactions in the Pittsburgh region, with Continuim Equity Partners, Gray Matter Systems LLC and Nortap Technology Inc. all completing acquisitions within the month.

Deal of the Month

On July 27, 2023 Incline Equity Partners sold its portfolio company, Specialty Products and Insulation, a distributor and fabricator of insulation and complementary products, to TopBuild (NYSE: BLD).

Headquartered in Daytona Beach, Florida, TopBuild is a leading installer and specialty distributor of insulation and building material products to the residential, commercial and industrial construction industries in the U.S. and Canada.

When asked about the transaction, Robert Buck, CEO of TopBuild stated, “The acquisition of SPI is highly strategic for TopBuild, accelerating Specialty Distribution’s growth and enhancing our leadership position in the very diverse and fragmented insulation industry… SPI generates significant recurring revenue from industrial maintenance and repair. When combined with our Specialty Distribution business today, we estimate recurring revenue will account for approximately one third of the segment’s overall revenue stream.”

TopBuild anticipates this transaction will entrench its position as a leading specialty distributor in the highly fragmented residential, commercial, and industrial building end markets it serves. ●

Andrew Chalhoub is an analyst with MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].