The COVID-19 pandemic plunged the world into uncertainty, changing both consumer lifestyles and business practices. While some changes were temporary, others have proven to be more durable, and one long-lasting change that has directly impacted M&A is the transition to a highly virtual deal environment.

Prior to 2020, M&A due diligence had already become increasingly more expansive. The steady improvement of information technology and the rapid proliferation of data facilitated this trend. Simply put, businesses today have access to significantly more data than businesses of yesterday, providing acquirers with more information to process. The turbulent economic environment that the pandemic left in its wake further increased the due diligence requirements of a typical transaction. It added more risk areas that require diligence, with due diligence also becoming more thorough within each risk area. Meanwhile, the decentralized, remote work environment imposed by the pandemic inhibited another key area of M&A due diligence — face-to-face meetings and facility tours.

Enter the solution — virtual technology, which has been embraced equally by both sellers and acquirers. Today, due diligence is primarily conducted on a virtual basis, with videoconferences supplanting (or supplementing) in-person meetings, virtual facility tours taking the place of site visits, and virtual data rooms and other file-sharing applications used to convey information digitally. A highly virtualized due diligence process is improving efficiency, saving time and cost, and satisfying acquirers’ needs to conduct comprehensive due diligence in a turbulent global economy. And we expect that virtual M&A is here to stay.

M&A Market Activity

National deal volume slowed meaningfully in July 2022, as inflation and other economic headwinds have increasingly impacted M&A activity. U.S. M&A deal volume for the seven months ended July 31, 2022, was 11.5 percent lower than the same period in 2021, while deal volume for July 2022 was 31.2 percent lower than July 2021.

The Greater Pittsburgh M&A market has exhibited a similar trend to the broader domestic market, as deal volume for the seven months ended July 2022 was 28.5 percent lower than the prior year. Meanwhile, Greater Pittsburgh deal volume fell by 7.1 percent in July 2022 relative to July 2021.

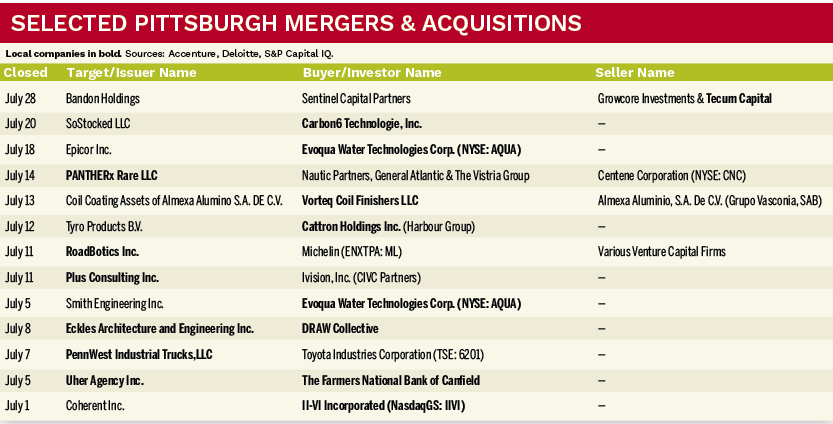

Regardless, July 2022 saw the closing of several noteworthy transactions, both from strategic and private equity acquirers. Pittsburgh-based Evoqua Water Technologies Corp. (NYSE: AQUA) completed two disclosed acquisitions within the month, while Saxonburg-based II-VI Inc. (NasdaqGS: IIVI) also made a strategic acquisition.

Meanwhile, several notable private equity transactions involving Greater Pittsburgh businesses were also completed, as Nautic Partners (Providence, Rhode Island), General Atlantic (New York) and The Vistria Group (Chicago, Illinois) partnered in the acquisition of Pittsburgh-based PANTHERx Rare LLC from Centene Corp. (NYSE: CNC), and Bridgeville-based Plus Consulting, Inc. was acquired by Ivision Inc., a portfolio company of CIVC Partners (Chicago, Illinois).

Deal of the month

On July 14, 2022, an investor group that included three leading private equity groups — Nautic Partners, General Atlantic and The Vistria Group — partnered in the acquisition of PANTHERx Rare LLC from Centene Corp. (NYSE: CNC).

Headquartered in Pittsburgh, and originally acquired by Centene in December 2020, PANTHERx is an award-winning provider of rare and orphan disease pharmacy services, having been recently awarded Specialty Pharmacy of the Year by the National Association of Specialty Pharmacy, as well as the Accredited Distinction in Rare Diseases and Orphan Drugs from the Accreditation Commission for Health Care. According to Rob Snyder, CEO of PANTHERx, “PANTHERx is deeply committed to redefining and enhancing specialty pharmacy by anticipating the diverse needs of the patients we serve. With the enhanced resources brought by The Vistria Group, General Atlantic and Nautic Partners, we’re confident in the investment’s potential to deliver innovative outcomes for patients suffering from rare and orphan diseases.”●

Matt Figas is a Vice President with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].