Rolled equity, or a rollover, is when the existing owners of a business sell the majority of their ownership interest but maintain a minority stake in the new entity structure, essentially reinvesting a portion of the sale proceeds — usually 10 to 40 percent of total equity value — back into the company.

The primary reason for buyers to include a rollover in their purchase price is to ensure that buyer and seller interests are aligned post-closing. Structuring a purchase offer to include a rollover equity stake is also a way to narrow the gap between buyer purchasing power and total sale price. The result allows for acquirers to spend less cash at close. Additionally, a buyer can reduce some of the risk associated with an acquisition by sharing it with a minority owner.

Rollover equity is particularly intriguing to sellers who have built their business and want to continue to capitalize on its future success, often referred to as getting a second bite of the apple. In this scenario, an increase in value over the acquirers hold period — typically three to seven years when the buyer is a private equity group — means more money for the seller when the business is sold a second time. Instead of cash up front, the initial seller is deferring compensation in hopes of a larger future payout. Accepting a rollover as a portion of purchase price can also allow the seller to achieve a higher overall enterprise value while providing the opportunity to defer taxes.

Recently, noncash forms of purchase price, including rollovers, have become more common and a more significant portion of enterprise value. This has allowed buyers to maintain higher valuation multiples while facing a tighter credit market and general market uncertainty.

M&A market activity

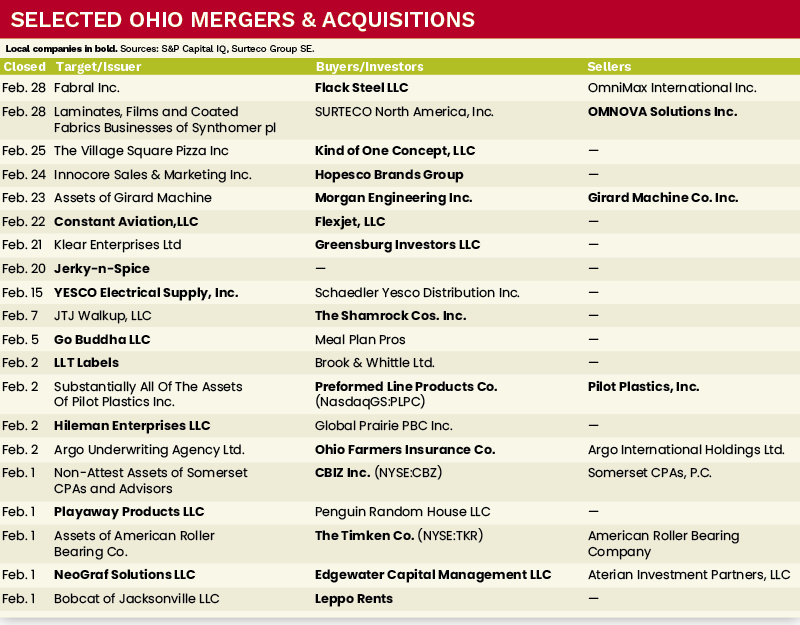

Domestic deal volume trends were consistent with January, remaining below 2022 levels. U.S. M&A deal volume for February 2023 was 28.3 percent lower compared to February 2022.

The Northeast Ohio M&A market realized a decline in deal volume in February 2023, which was 23.1 percent lower compared to February 2022. However, February 2023 still realized several noteworthy transactions in the Northeast Ohio region, primarily driven by strategic acquirers.

Northeast Ohio-based companies Flack Steel, Flexjet and Ohio Farmers Insurance Co. completed strategic acquisitions within the month. In addition, Cleveland-based private equity group Edgewater Capital Management completed an acquisition of NeoGraf Solutions.

Deal of the Month

On Feb. 28, 2023, Surteco Group SE announced the acquisition of OMNOVA Solutions’ laminates and performance films and coated fabrics division from its parent company, Synthomer PLC. The division specializes in producing and selling laminates, foils and vinyl-coated fabrics.

According to Wolfgang Moyses, chairman of the management board of Surteco Group SE, “This acquisition will strengthen our position in the market for decorative surfaces in North America and it represents an important step for sustainable development of the Sureteco Group.” ●

David Shibley is an analyst with MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].