The labor market received highly promising feedback in the recently released May jobs report, which revealed a substantial increase of 339,000 nonfarm payrolls. This surge in numbers caught many by surprise, surpassing Dow Jones estimates by 78.4 percent. Driven by the business services, government, and health care sectors, the significant deviation between the projected and actual figures highlights the labor market’s resiliency and signifies a remarkable acceleration in May job creation.

Despite the nonfarm payroll growth, national unemployment jumped from 3.5 percent in April to 3.7 percent in May, which was the highest since October 2022. However, this was largely driven by a 369,000 decline in self-employment, implying that entrepreneurs, freelancers and individuals engaged in contract work are those currently facing labor challenges. Additionally, average hourly earnings month over month are stabilizing, increasing only 0.3 percent. All of these factors are considerations that the Federal Reserve will need to take into account when evaluating the state of the economy, but historically, these are positive signs of moving toward a soft landing.

The report’s implications for the M&A community are significant, as companies are increasingly motivated to engage in M&A activities to fortify market presence, improve competitive advantage and foster overall growth. The growth in nonfarm payroll jobs serves as a testament to the expanding opportunities within established businesses and organizations, reinforcing the positive outlook for strategic acquisitions. Additionally, the deceleration in wage growth and stabilization in average hourly earnings create a favorable environment for companies to address concerns related to inflation, mitigate financial risks, and allocate capital toward M&A activities.

Strategic acquisitions have already made a significant impact, representing an impressive 79.7 percent share of the total 2023 M&A activity in the U.S. If the positive trend of increased job opportunities and the stabilization of wages persists, the M&A environment will remain promising for strategic acquisitions.

M&A Market Activity

U.S. deal volume declined in May 2023 as compared to the prior month. Through the first five months of 2023, U.S. M&A deal volume decreased more than 25.4 percent compared to same period in 2022.

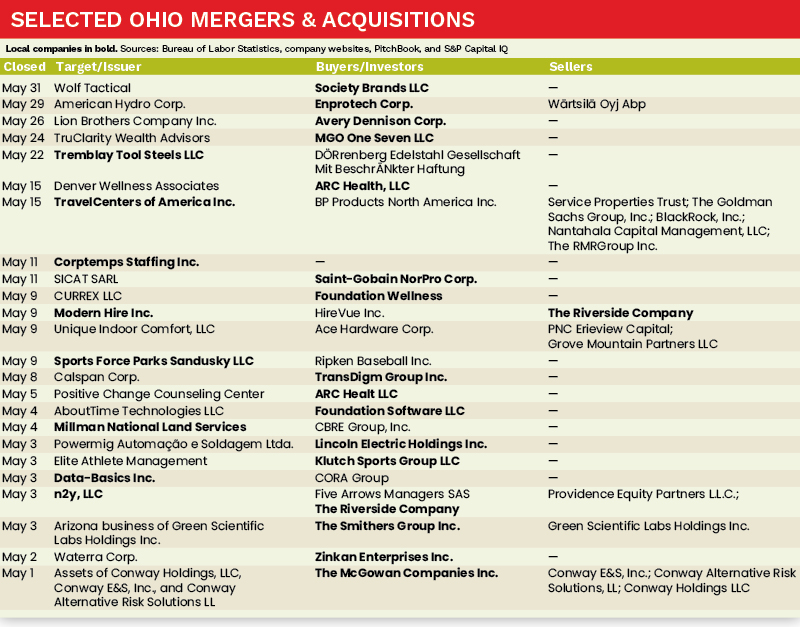

The Northeast Ohio M&A market experienced an increase in deal volume in May 2023, with deal volume rising by 33.3 percent as compared to April 2023. May 2023 saw several noteworthy transactions in the Northeast Ohio region, including strategic acquisitions by Northeast Ohio-based companies Society Brands LLC, Lincoln Electric Holdings Inc., Klutch Sports Group LLC and Foundation Wellness.

Deal of the Month

In May 2023, ARC Health, LLC, a mental health support platform catering to private practices, showcased substantial activity in the M&A space by finalizing two strategic acquisitions. On May 5, ARC Health completed the acquisition of Positive Change Counseling Center, a mental health practice that offers in-person and telehealth counseling services across four facilities. Additionally, on May 15, ARC Health acquired Denver Wellness Associates, a clinical care provider with two well-established locations in the Denver, Colorado area. ARC Health’s growth strategy remains focused on strategic acquisitions, with these transactions expected to play a pivotal role in the company’s overall expansion. In line with this approach, ARC Health, a portfolio company of Thurston Group, has completed five acquisitions in 2023. ●

Carter Hatina is an Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].