In 2023, various factors posed challenges to the mergers and acquisitions (M&A) market. Rising inflationary pressures increased borrowing costs and complicated valuation, influencing strategic decision-making and regulatory scrutiny.

In 2023, various factors posed challenges to the mergers and acquisitions (M&A) market. Rising inflationary pressures increased borrowing costs and complicated valuation, influencing strategic decision-making and regulatory scrutiny.

Additionally, escalating interest rates and overall macroeconomic uncertainty prompted many dealmakers to abstain from engaging in transactions, especially when compared to record years following the COVID-19 pandemic. Despite these challenges, 2024 holds promising developments and factors fostering optimism within the marketplace, especially within founder-owned companies.

One of the main drivers of the 2024 M&A market will be the anticipated increase in founder-owned company transactions. Private equity interest in non-institutionally backed companies waned during the COVID-19 pandemic, as these companies faced challenges in maintaining valuations and financial stability amid the crisis. However, the conclusion of 2023 witnessed a surge in non-institutionally backed companies within private equity portfolios. This segment accounted for 56.1 percent of private equity deals as of November 2023, marking a notable 10.6 percent increase since the first quarter of 2021.

Additionally, founder-owned businesses often present lower purchase price multiples compared to other acquisition targets. This becomes particularly advantageous in the context of an unstable interest rate environment where borrowing costs are on the rise. Moreover, with the significant $955.7 billion in dry powder held by U.S. PE firms, private equity buyers find themselves increasingly incentivized to proactively seek out nonbacked targets.

Looking at 2024, the M&A market faces new prospects amid the challenges of 2023. Over the last year, rising inflationary pressures and escalating interest rates dampened transactional activity, yet optimism prevails with the anticipated surge in founder-owned company transactions and the resurgence of private equity interest in non-institutionally backed targets. These developments, alongside the substantial capital reserves of U.S. private equity firms, signal significant potential in the year ahead, promoting fresh opportunities for strategic growth and investment within the marketplace.

M&A market activity

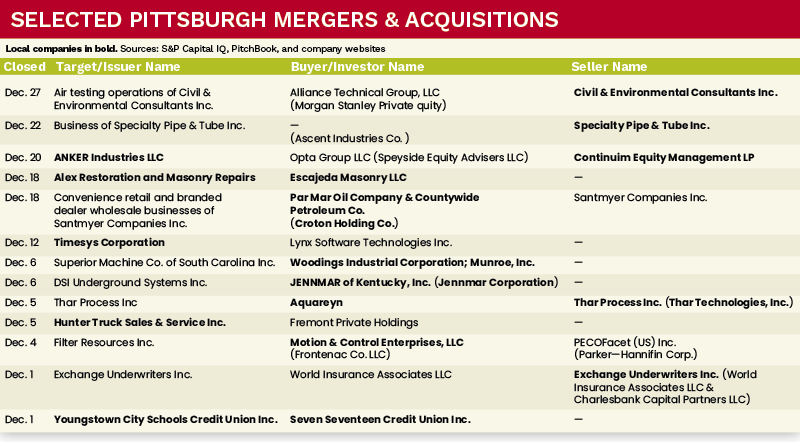

In January 2024, the U.S. M&A landscape experienced a significant 30.3 percent month-over-month increase in deal volume. This surge represents the most substantial month-over-month growth observed since December 2021. During the corresponding period, the Pittsburgh M&A market witnessed a modest decrease in deal volume, with a 7.7 percent month-over-month decline noted in January 2024.

Despite this, January 2024 saw the closing of several noteworthy transactions in the Pittsburgh market from strategic acquirers. Pittsburgh-based companies Lee Supply Co. Inc., Innovation Works Inc. and Motion & Control Enterprises LLC all completed strategic acquisitions within the month.

Carter Hatina is an associate at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].