Sharply increasing inflation rates over the past two and a half years in the U.S. are a result of several contributing factors, but none more than the relationship between the prices for goods and services, and the labor market.

As the ratio of job vacancies to unemployment has steadily increased, labor market participants and jobseekers alike have bargained for better pay. This has led businesses to charge more for goods and services to meet the rising demand for higher wage rates. After more than 10 consecutive quarters of increased Federal Funds Interest Rates, Federal Reserve Chair Jerome Powell’s strategy to temper the aforementioned pricing pressures may finally be achieving relative success. At the end of June 2023, the reported U.S. inflation rate reached approximately 3 percent, the lowest rate since March 2021. The decline in U.S. inflation is a step in the right direction and may allow for the past two years of increased borrowing costs to subside.

While the domestic cost of capital has increased, it remains at a relative historical low — an important factor when analyzing domestic M&A market activity. The recent modest decline in overall deal activity appeared to be inevitable relative to the near-historic pace of closed transactions that followed the COVID-19 pandemic. And overall transaction values remain at record levels due in part to:

- Tremendous amounts of committed, but uninvested, private equity capital

- Generous levels of cash on corporate balance sheets

- Relatively low costs of capital

- Financial institutions’ propensity to lend on high-quality assets

M&A Market Activity

U.S. deal volume declined in June as compared to the prior month. Through the first two quarters of 2023, U.S. M&A deal volume decreased by 16.1 percent compared to the second half of 2022.

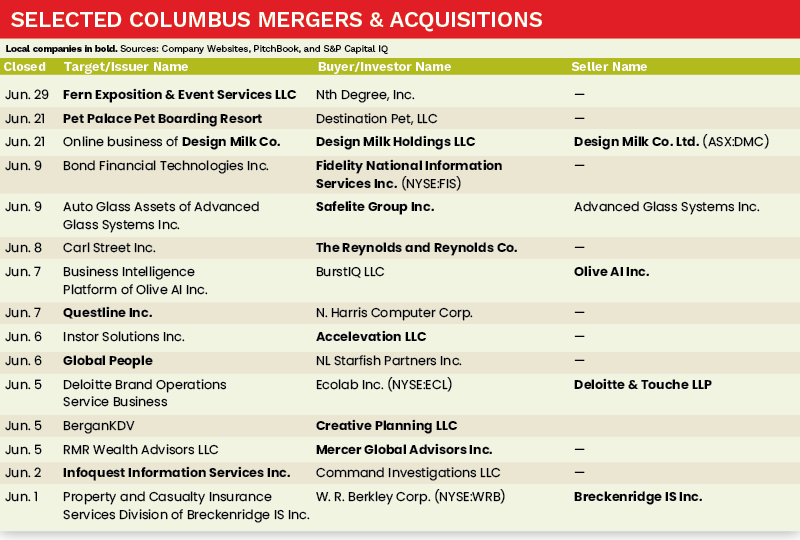

The Columbus M&A market experienced an increase in deal volume in June 2023 of 33.3 percent as compared to May 2023. June also saw several noteworthy transactions in the Columbus region, with Mercer Global Advisors Inc., Fidelity National Information Services Inc. (NYSE:FIS), and Safelite Group Inc., all completing acquisitions.

Deal Of The Month

In an effort to capitalize on the growing interest of investment in the pet — and particularly companion animal —space, Denver-based and Luxembourg’s LetterOne Holdings-backed Destination Pet acquired Columbus’ Pet Palace Pet Boarding Resort.

Pet Palace operates 11 pet care facilities throughout Ohio, Indiana, North Carolina and Pennsylvania — enabling Destination Pet to greatly strengthen its position as one of the fastest-growing and largest consolidators of pet care resorts in the U.S.

Jennifer Strickland Fowler, CEO of Destination Pet, stated, “We are incredibly excited to welcome Pet Palace and their 500+ employees into the Destination Pet pack. This acquisition aligns with our growth strategy and reinforces our commitment to becoming the go-to destination for pet care services. Pet Palace’s remarkable reputation, top-tier facilities and multi-state footprint enhance our portfolio, and their commitment to exceeding the expectations of their pet families aligns with our own. Together, we will continue to raise the bar in pet care.” ●

Anthony Melchiorre is a Vice President with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].