As interest rates and borrowing costs move in parallel, buyers are faced with the challenge of navigating increasing costs of debt to finance acquisitions, especially in deals where the seller has experienced significant growth in recent years or in acquisitions requiring sufficient working capital. In such scenarios, buyers may turn to an earnout, a seller’s note, or a combination of both alternative financing options to offer a higher enterprise value and prevail in a competitive bidding process.

Earnouts have become particularly appealing as they allow buyers to structure a portion of the purchase price based on the target company’s future performance. Instead of carrying a higher upfront cost of debt burdened by elevated interest rates, the buyer can commit to additional payments at a later day that will be contingent upon achieving specific post-acquisition financial targets. This financial structure also incentivizes sellers to actively support the post-acquisition integration and performance of the company, as their future payout is linked to the business’s success.

Similarly, seller notes have gained popularity in the face of increasing interest rates. Sellers may be more willing to accept deferred payments in the form of a seller’s note to gain additional purchase price, prevent purchase price reductions, or generate passive income through a favorable interest rate. For the buyer, the seller’s note can delay payment obligations to a later date, easing the immediate financial burden and improving operational cash flow for immediate growth projects. This approach aligns the interests of the buyer and seller, enabling the seller to secure a higher overall deal value while reducing the buyer’s immediate cash outlay.

These financing mechanisms help buyers and sellers navigate the challenges posed by higher borrowing costs and valuation gaps, fostering collaboration and risk-sharing to achieve successful M&A outcomes.

M&A Market Activity

U.S. deal volume continued to underperform previous periods with activity decreasing by 12.8 percent from June 2023 to July 2023, and TTM volume decreasing by 27.6 percent as compared to the same period through July 2022.

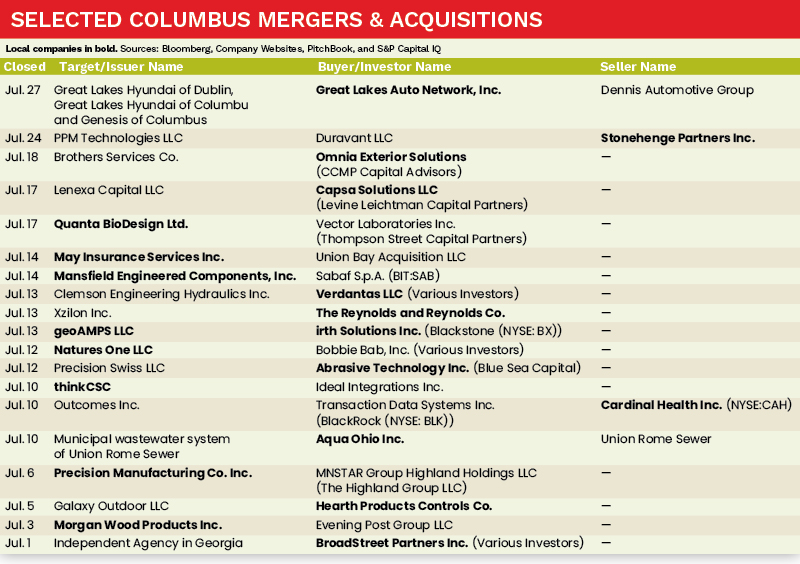

Although the Columbus M&A market observed a decrease of 15 percent in YTD July 2023 in comparison to YTD July 2022, the region experienced an increase in deal volume in July 2023 by 18.8 percent, when compared to June 2023.

Furthermore, July 2023 saw several noteworthy transactions in the Columbus, Ohio, region, with Cardinal Health Inc. (NYSE: CAH), Abrasive Technology Inc. and Verdantas LLC,all completing acquisitions within the month.

Deal of the Month

On July 24, Duravant LLC, acquired PPM Technologies from Stonehenge Partners. PPM is a manufacturer of high-quality conveying, coating, and thermal equipment headquartred in Newberg, Oregon. PPM designs, engineers and manufacturers processing solutions for a wide range of end markets including snack foods, confectionary, cereals, nutraceuticals, nuts and seeds, vegetables and meats.

Headquartered in Downers Grove, Ilinois, Duravant is a global engineered equipment company that offers designs and assembles mission-critical equipment, including form-fill-seal machines, robotic palletizers, conveyors and thermal processors, helping its customers to optimize safety, productivity, efficiency and connectivity.

When asked about the transaction, Andrew Bohutinsky, managing partner of Stonehenge Partners said, “We have enjoyed a great working relationship with the PPM team over the last four and a half years. We are very pleased with the growth of the business under our stewardship and look forward to its continued success within the Duravant family of companies.” ●

Andrew Chalhoub is an Analyst with MelCap Partners, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].