Merger and acquisition transactions are complex financial endeavors that require careful consideration of valuation strategies. Toward the end of 2023, the use of innovative structures, such as earnouts and seller notes, have gained prominence in supporting M&A valuations in effort to achieve seller expectations.

Earnouts and seller notes are financial instruments designed to bridge valuation gaps between buyers and sellers in M&A transactions. An earnout is a contractual arrangement where a portion of the purchase price is contingent upon the future performance of the acquired business. Seller notes, on the other hand, involve the seller providing financing to the buyer by accepting a promissory note in lieu of an immediate cash payment.

Risk Mitigation: Earnouts allow sellers to share in the risks associated with future business performance. This alignment of interests ensures that sellers remain invested in the success of the business post-acquisition, thereby promoting a smooth transition and enhancing overall value. Seller notes, by deferring a portion of the purchase price, provide buyers with flexibility in managing their cash flow. This structure helps mitigate financial risks associated with the acquisition, especially when uncertainties exist around the acquired company’s future profitability.

Valuation Flexibility: Earnouts provide flexibility in determining the purchase price based on the achievement of specific performance metrics. This is particularly valuable in industries with evolving market dynamics or where the full potential of the acquired business is challenging to assess at the time of the transaction. Seller notes offer a creative way to structure deals, enabling buyers and sellers to negotiate terms that consider the financial health of the acquiring company, prevailing market conditions, and other external factors.

Deal Financing: Seller notes contribute to deal financing by allowing buyers to spread the payment over an extended period. This can be particularly advantageous in situations where immediate access to funds is constrained, providing buyers with the necessary time and resources to integrate the acquired business seamlessly. Earnouts, tied to future performance, can also serve as a form of financing, with the success of the business post-acquisition directly impacting the final purchase price.

In the dynamic landscape of M&A transactions, the strategic use of earnouts and seller notes has become increasingly prevalent. These structures not only address valuation challenges, but also foster collaboration between buyers and sellers, encouraging a shared commitment to the long-term success of the business. As we look towards 2024, the judicious application of earnouts and seller notes will continue to play a pivotal role in shaping the financial landscape of M&A transactions.

M&A Market Activity

Deal volume within the U.S. declined by 37 percent when comparing December 2023 to the same month in 2022. However, disclosed deal value within the U.S. expanded by 20.3 percent when comparing December 2023 to the same month in 2022.

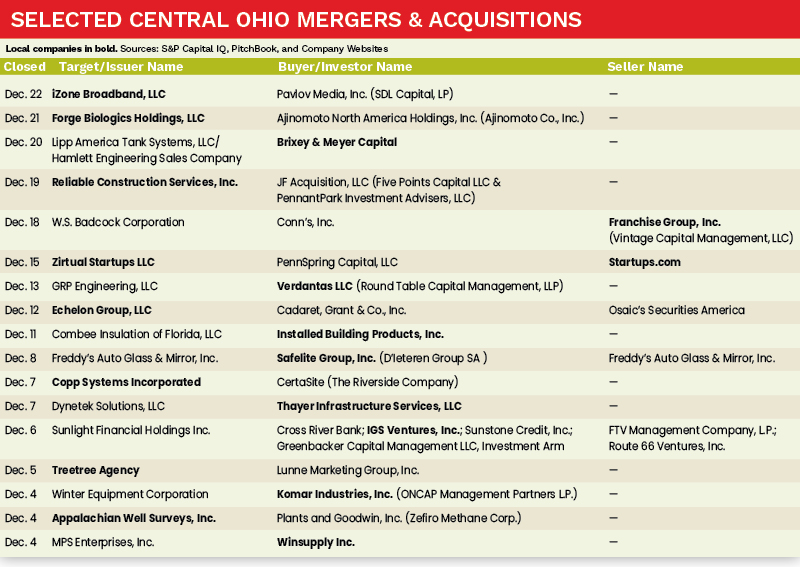

Deal volume within the Columbus M&A market remained consistent, but to a lesser degree, with the broader U.S. M&A market, as deal volume in December 2023 declined 5.6 percent when compared to December 2022. The Columbus region saw several noteworthy transactions for the month of December 2023, which includes acquisitions from the following Columbus Ohio-based companies: Installed Building Products, Inc., Safelite Group, Inc., and Winsupply Inc.

Deal of the Month

Brixey & Meyer Capital, a lower middle-market private investment firm, recently acquired Lipp America Tank Systems, LLC/ Hamlett Engineering Sales Company on December 20, 2023. Both of these businesses are renown service providers and process equipment distributors to the municipal water and large waste producer market. Each business was acquired by Kevin Livingston and Glenn Hummel, who plan to remain involved post-close, and will be complementary from a positioning perspective enabling strategic expansion into adjacent markets in order to broaden its service and product capabilities.

Evan Lyons is a Vice President at MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].