To successfully acquire a business, there are many challenges and obstacles that are required to complete the transaction. First, one needs to determine its acquisition rationale and criteria. Inorganic growth by way of strategic acquisition can make sense for a business for a variety of reasons, including access to new markets, product line diversification, expansion of production capabilities, geographical expansion and access to talent in both management and production.

Once the acquisition rationale has been determined, and the target identified, an experienced deal team is paramount to successfully navigating the complexities of the transaction to close the deal. In today’s environment, it’s getting even more complex. One of the most critical aspects of a successful transaction, which can sometimes be missed or overlooked, is cultural fit.

Cultural fit is a crucial aspect in any M&A transaction because it can significantly impact the success or failure of the deal. Cultural misalignment poses a risk to the success of the merger. Issues such as conflicting values, communication breakdowns and resistance to change can disrupt operations and lead to the failure of the M&A deal. There are several reasons cultural fit matters, but here are a few that can determine success or failure.

Employee morale and engagement. A harmonious cultural fit helps maintain employee morale during times of change. When employees see a seamless integration of cultures, they are more likely to feel secure, engaged and motivated.

Retention of key talent. Cultural alignment contributes to the retention of key talent. Employees who identify with the newly formed culture are more likely to stay with the organization, reducing the risk of losing valuable skills and experience.

Communication and collaboration. A shared cultural foundation fosters effective communication and collaboration. When employees understand and embrace a common set of values and norms, it becomes easier to work together toward common goals.

Reduction of resistance to change. M&A transactions inherently involve change, and employees may resist change if they feel their culture is being disregarded. Cultural fit minimizes resistance by incorporating aspects of both organizations, creating a more inclusive and accepting environment.

Productivity and efficiency. A cohesive culture can contribute to increased productivity and operational efficiency. When teams are aligned culturally, they are more likely to understand each other’s working styles and processes, leading to smoother operations.

Cultural fit matters in M&A transactions because it directly impacts the human aspect of the integration process. Organizations that prioritize cultural compatibility are better positioned to create a cohesive and high-performing merged entity, leading to long-term success and sustainable growth.

M&A market activity

Deal volume within the U.S. declined by 26.3 percent when comparing November 2023 to the same month in 2022. However, disclosed deal value within the U.S. expanded by 94.6 percent compared to the same month in 2022.

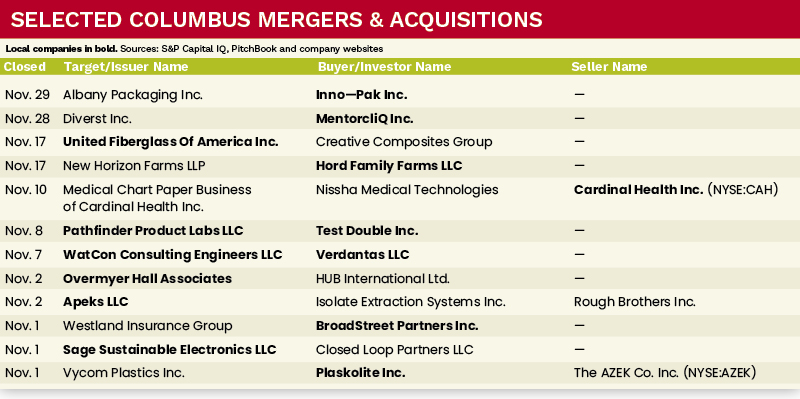

Deal volume within the Columbus M&A market remained consistent with the broader U.S. M&A market, as deal volume in November 2023 declined 40 percent compared to November 2022. The Columbus region saw several noteworthy transactions for November 2023, which includes acquisitions by BroadStreet Partners Inc., Plaskolite Inc. and Verdantas LLC.

Deal of the Month

Inno-Pak LLC, an industry-leading designer, manufacturer, importer and supplier of eco-friendly packaging for foods, closed on the acquisition of Albany Packaging Inc. Albany, headquartered in Ontario, Canada, specializes in the design and manufacture of custom and stock folding paperboard carton, and serves customers across the food service, grocery and convenience store channels.

Chris Sanzone, CEO of Inno-Pak, says, “We are excited to add Albany’s facilities, products and people to Inno-Pak as we strive to bring our world-class customers the best packaging available anywhere. This acquisition increases our North American integrated manufacturing capabilities and marks a crucial step in our manufacturing expansion plan to create an even more resilient supply chain.”

Al Melchiorre is president and CEO of MelCap Partners LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, visit www.melcap.com or email [email protected]. ●