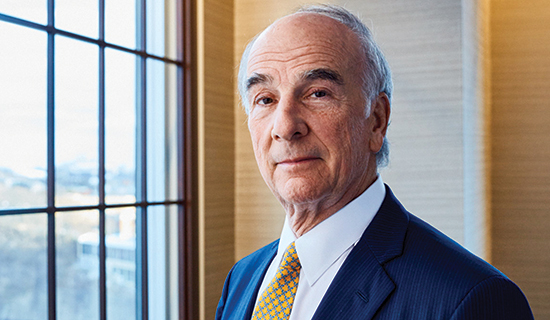

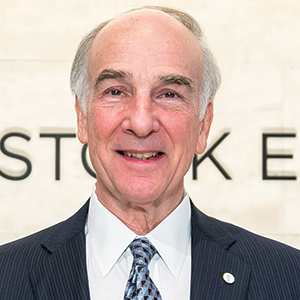

J. Christopher “Chris” Donahue and his team celebrated their 2018 acquisition of Hermes Investment Management with a big “rah-rah day” in February 2020 — marking the firm’s official rebrand from Federated Investors Inc. to Federated Hermes Inc. and, with the ringing of the Opening Bell at the New York Stock Exchange, its new ticker symbol (FHI).

Then, within a matter of weeks, the world suddenly shut down. Despite the global pandemic, the momentum of the long-awaited merger carried the firm smoothly through the transition. Thanks to several years of due diligence, Donahue knew the deal had all the ingredients to succeed. The acquisition of Hermes, with $47.2 billion in assets under management, created a union of nonoverlapping investment strategies with a strong cultural fit and an international presence to make the resulting entity much larger than the sum of its parts.

But instead of absorbing the London-based firm into the Federated model, Donahue saw an opportunity for “reverse transformation,” as he told Smart Business Pittsburgh back in 2019. He adopted Hermes’ investment strategies across the larger firm — specifically its focus on environmental, social and governance (ESG) criteria when evaluating a company’s overall performance. By incorporating these ESG factors alongside its traditional financial analysis, Federated Hermes is quickly becoming a world leader in responsible, sustainable investment management.

“Our friends in London brought the heritage of ESG to the table, and we brought the strength of our fiduciary duty,” says Donahue, president and CEO. “It was a beautiful confluence of fiduciary duty and ESG heritage that’s now wrapped up in responsible investing, which means we’re evaluating companies over the long haul for the purpose of getting excellent performance. We believe that responsible investing leads to wealth creation over the long term, and we think that’s the right way to go.”

Investing sustainably

Investment analysts weren’t traditionally concerned with ESG factors like energy consumption or inclusive hiring practices because they were only focused on short-term financial gains, Donahue explains.

“They only want to know: ‘What is it this quarter, and what’s it going to be the next two or three quarters?’” he says.

By contrast, Federated Hermes takes a long-term perspective when evaluating investments. Rather than looking at the next quarter or even the next year, they’re looking at companies “with a five- to 10-year evaluation attitude,” Donahue says.

This long-term view requires looking beyond the current balance sheets to take a more holistic look at operations, from business ethics to supply chain management and other ESG factors.

“If the purchaser of hamburger meat is interested in the fact that the cows are treated properly, then you’ve got to know what’s going on in the supply chain of the meat company,” Donahue says. “These are the kind of factors that matter to someone who’s looking five to 10 years, versus somebody who’s looking at a few quarters or even a couple of years.”

In a 2020 survey, Federated Hermes learned that 90 percent of financial advisers were fielding questions about ESG investing, but fewer than 25 percent of them were confident talking about it with clients. To bridge this gap, Federated Hermes launched a Responsible Investing Institute in 2021 to train investment professionals (both within the firm and beyond) about the role of ESG factors in investing. Web-based courses cover key ESG concepts and approaches, how to navigate ESG data and how to communicate these factors to clients — in other words, “what’s in it for the customer and why this matters for long-term wealth development,” Donahue says.

Taking the pledge

In addition to adopting Hermes’ ESG investing framework, Federated also embraced the London firm’s corporate pledge. In nine simple statements, this pledge declares the firm’s commitment to core values like acting “ethically, responsibly and with integrity,” putting client interests first and treating people with dignity and respect.

More than 95 percent of the 2,000 employees at Federated Hermes have voluntarily signed the pledge. However, Donahue doesn’t track who has or has not signed it; he’s more focused on whether or not employees are living these values, day in and day out — and that starts with the example set by the leadership team.

“The leadership of the company has to do the right thing for the right reason in the right way,” he says. “If that’s not happening, you can have all the pledges on the walls you want, but it’s not going anywhere. It’s living it that makes the culture tick.”

One of the most visible ways the firm puts these values into action is through charitable giving. At every level of the organization, employees are encouraged to participate in their local communities by sharing their time and talents. The firm supports these individual efforts by granting employees time off for community service and giving corporate donations to the causes that associates support.

The firm also organizes volunteer opportunities where employees can give back together as a team. Earlier this year, when all 250 sales associates gathered for their first in-person sales conference since the COVID pandemic, they spent one afternoon at Pittsburgh’s Northside Food Panty, organizing 2,000 pounds of food and personal care items for neighbors in need.

Over the last 40 years, the firm has gifted nearly $40 million through more than 7,000 donations to 1,800 charities across the U.S. Donahue says these charitable efforts align perfectly with his father’s motivation for founding the firm back in 1955. The three “founding fathers” of the firm had 27 children between them, including 13 children in Donahue’s family.

“They wanted to grow those families in Pittsburgh,” Donahue explains, and now, that sense of family stretches throughout the communities surrounding Federated Hermes.

“We’re very proud of that work,” Donahue says. “All of us live in the community, so [giving back to] the community is a real key.”

Building a team

Another idea that Federated lifted from Hermes through the merger was the internship program that it had implemented as a way to get high school students interested in financial services. When Federated Hermes had to hire hundreds of employees during the pandemic to keep up with post-merger growth, internships became a useful tool for filling the talent pipeline.

Now, Federated Hermes partners with a range of local high schools like Nazareth Prep, an independent high school for students from underserved communities in Pittsburgh, and other educational programs like First Workings, which connects students in New York City to paid internships. The firm brings in about 70 interns each year — which, Donahue says, helps with recruiting and onboarding potential employees by showing them how the organization runs.

In addition to these internships, the firm maintains “a pretty aggressive recruiting” program by partnering with nearby colleges. The goal is to become a “go-to” choice for students in financial fields at local colleges like Pittsburgh’s Duquesne University, which bears the name of Donahue’s father in its Palumbo-Donahue School of Business.

After new hires join Federated Hermes, the firm has several programs in place to embed them into the team. For example, a buddy program connects new hires with a peer, either in terms of age or job level, who can answer general questions about the work environment as they get settled into their role. This program grew out of the firm’s mass hiring bout during the pandemic, as a way of helping new employees find friends and learn the ropes, even when they weren’t in the office together.

The buddy program is separate from the mentorship program, which is a more formal effort to connect employees with a long-term career coach in the firm who can offer advice over time.

“The buddy program is designed to get people comfortable; it’s a methodology of inclusion,” Donahue says, “whereas the mentoring program is for longer-term career [guidance].”

The key, he says, is that Federated Hermes continues investing in employees to create an environment where people feel supported and actually enjoy coming to work.

Growing across the globe

The last time Smart Business Pittsburgh featured Federated Investors on the cover back in June 2019, after its acquisition of Hermes but prior to rebranding, the companies reported combined 2018 annual revenue of just over $1 billion with about $460 in assets. Fast-forward: Federated Hermes ended 2022 with nearly $669 billion in total assets under management, and by the first quarter of 2023, hit a record $701 billion in assets — and growing, both domestically and internationally.

“We’ve been able to leverage the strong performance in equities and fixed income,” Donahue explains. “We have about two dozen funds that have positive flows so far this year, and more than half of them are in London. Last quarter (Q4 2022) we were able to announce that our pipeline of committed but not yet invested monies was the biggest ever at $4.8 billion — over $3 billion of that was from our London office, and that was largely private markets. Five years ago, nobody was talking about the private markets section of the Hermes enterprise, and here we are, announcing our biggest pipeline.”

Equity assets are growing equally in the U.S. and U.K., with $84 billion in combined assets.

“And fixed income is set up for some pretty good growth, too,” Donahue says, with $88 billion in fixed income assets as of Q1 2023. Meanwhile, money markets have been a big driver of domestic growth for Federated Hermes, with money market assets hitting a record $506 billion in Q1.

Topping off this growth streak, Federated Hermes made another addition in October 2022 when it acquired C.W. Henderson & Associates Inc. in Chicago, a $3.5 billion specialist in municipal-bond separately managed accounts (SMA).

“The SMA growth so far this year has been outstanding,” Donahue says. “So, you look across the pond and you see good pipelines in the private markets and the equity offerings, then domestically, the money market funds, equity funds and the SMAs.”

This diversified growth is driving the firm forward, through the challenges of the pandemic and the hurdles of a major merger, to strengthen its investment management legacy on an international stage.

“All of this is wrapped up in the concept we went public with in ’98, which was ‘a franchise for all seasons,’ and that’s what we called ourselves. You’ve got money market funds, equity funds, fixed income funds, international funds,” Donahue says, “and the organization is therefore stronger because it can score on a lot of streets.” ●

TAKEAWAYS

- Look beyond the balance sheet to consider the long-term impact of your operation.

- Pledge to put your core values into action by giving back to your community.

- Integrate new employees into the team through onboarding and mentoring.

- Diversify your growth across a range of international products.