The sale process for a business owner — in most cases a multigenerational family business — is an extremely emotional process and oftentimes a once in a lifetime occurrence. While several variables come into play over the more than nine month sale process, the emotional wear and tear on a business owner is often overlooked. However, appropriately understanding and identifying deal fatigue can allow for proper planning and prevent potential deal-breakers.

Deal fatigue is a prevalent challenge in the mergers and acquisitions (M&A) landscape, manifesting as a weariness or loss of momentum among business owners involved in prolonged negotiations. This phenomenon typically arises when deals take longer than anticipated to close, leading to a decline in enthusiasm and energy from both parties. Various factors contribute to deal fatigue, including extended due diligence processes, difficulty obtaining necessary third-party consultations and assessments, and complex negotiations over valuation and deal terms. As these negotiations drag on, business owners may experience frustration, decreased productivity, and a diminishing sense of urgency, potentially jeopardizing the success of the transaction.

The impact of deal fatigue on M&A transactions can be significant. Prolonged negotiations not only increase the costs associated with legal and advisory services, but also distract management from their day-to-day operational responsibilities. This distraction can lead to a decline in business performance, making the target less attractive and potentially reducing the perceived value of the deal. Moreover, deal fatigue can erode trust and collaboration between the parties, making it harder to finalize terms and achieve a successful integration post-acquisition. To mitigate deal fatigue, it is crucial for companies to maintain clear communication, set realistic timelines, and remain flexible in negotiations to keep all parties engaged and motivated throughout the process.

M&A Market Activity

U.S. deal volume decreased by approximately 3.3 percent in the second quarter of 2024 as compared to the first quarter of 2024, while YTD volume through the first half of 2024 decreased by approximately 11.9 percent as compared to the first half of 2023. However, deal volume for the first half of 2024 is up approximately 5.6 percent when compared to the second half of 2023, which shows further promise that the M&A market is remaining resilient despite countless factors impacting deal activity.

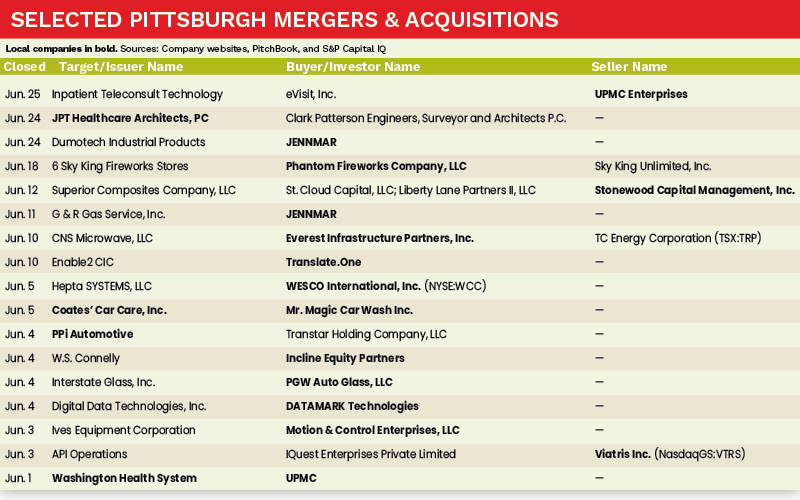

More specifically within the Pittsburgh M&A market, deal volume increased by approximately 42.4 percent in the second quarter of 2024 as compared to the first quarter of 2024, with several noteworthy transactions completed by both strategic acquirers and private equity firms. Phantom Fireworks Company, JENNMAR, and Motion & Control Enterprises all completed strategic acquisitions, while Incline Equity Partners also completed an acquisition.

Deal of the Month

The Pittsburgh deals of the month for June 2024 are the acquisitions of both G&R Services and Dumotech Industrial Products by JENNMAR (portfolio company of FalconPoint Partners), a Pittsburgh-based global provider of infrastructure products and specialized services to the civil, solar, mining, and construction industries.

“We are thrilled to join JENNMAR’s global family of companies,” said Greg Bostic, President of G&R Gas Services. “We take pride in all we do and are confident we have found the best possible partner to lead our next chapter of growth with the same trust and care upon which we are built.”

“We are thrilled to welcome Dumotech to the JENNMAR family of companies as we continue to build JENNMAR’s presence in Canada,” said Tony Calandra, CEO of JENNMAR. “Dumotech’s capabilities position JENNMAR to continue to meet the region’s hardrock market demand and better serve new and existing customers with our innovative products and services.”

Sources: Company websites, PitchBook, and S&P Capital IQ

Mike Kostandaras is a Senior Associate with MelCap Partners, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected].