Following a couple of strong years of M&A activity in terms of both volume and value, the broader M&A market has battled with the newfound challenges of obtaining financing, as well as its elevated associated costs, throughout 2023. As a result, dealmakers have become more selective acquirers in the M&A market by placing a greater emphasis on value creation and transformational growth in comparison to years past, which saw megadeals as headlines seemingly every month. While dealmakers, both corporations and private equity firms alike, navigate the current macroeconomic conditions impacting dealmaking activity, optimism remains high for strong transaction activity in the near future as M&A becomes a more pivotal growth strategy for businesses.

While megadeals have become scarcer in today’s economic landscape, M&A activity for smaller deals within the middle market have been able to navigate the aforementioned financing challenges and have become more favorable for both corporations flush with cash and private equity firms seeking strategic bolt-on acquisitions. From a competitive perspective, corporations with a significant war chest and robust integration processes have gained the advantage over private equity firms given corporations’ ability to realize synergistic benefits and avoid a tough financing environment. Private equity firms with a proven playbook and certitude for a specific business or industry remain aggressive throughout the acquisition process.

M&A Market Activity

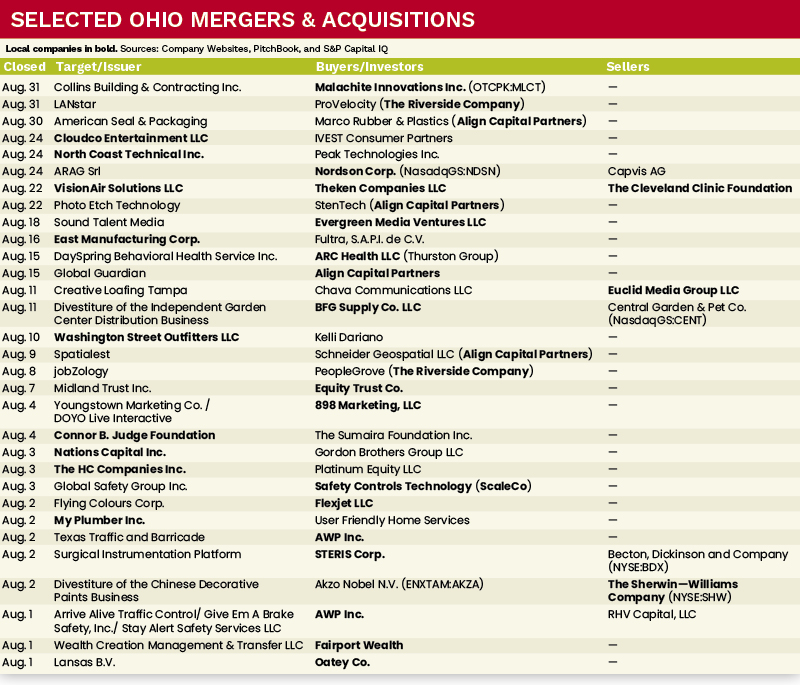

Deal volume within the U.S. for the month of August 2023 declined by 26.9 percent when compared to the same period in 2022. Deal volume, however, within the U.S. increased by 19.8 percent for the month of August 2023 when compared to the prior month.

The Northeast Ohio M&A market continued to see strong deal volume in August 2023 with deal volume increasing by 61.9 percent when compared to July 2023. August 2023 saw several noteworthy transactions in the Northeast Ohio region, with Align Capital Partners, AWP Inc., and ARC Health LLC, all companies with a greater-Cleveland presence, completing acquisitions within the month.

Deal of the Month

User Friendly Home Services, a home services company that focuses on HVAC across the U.S., has completed an acquisition of My Plumber Inc., a plumbing and general contractor in the Northeast Ohio region.

This acquisition is a testament to UFHS’s commitment to expand its services in the home services industry as the company continues to add plumbing companies to diversify capabilities.

“The entire organization at User Friendly Services always felt like a perfect fit for us,” said My Plumber Inc. CEO Daniel Zappola. “The resources now available to us through this partnership will allow us to not only continue to give our customers the A+ service they’re used to, but grow our offerings and continue to get better for them.” ●

Al Melchiorre is president and CEO and Jake Peebles is an Analyst with MelCap Partner, LLC, a middle-market investment banking advisory firm. For more information on MelCap Partners, please visit www.melcap.com or email [email protected] or [email protected].